Try a Simulator Before Investing Real Money

Putting resources into any market, particularly the digital money market implies risk and a huge expectation to learn and adapt. Before committing genuine assets, utilizing a test system can be a significant stage in figuring out the elements of the market and sharpening venture methodologies. The following is a manual for utilizing a test system before putting away genuine cash, stressing the significance of this methodology, the kinds of test systems accessible, how to pick the right one, and tips on expanding the experience. The idea of these strategies provide on correction territory.

Investing in real money involves:

Preparation

- Set clear financial goals

- Understand risk tolerance

- Develop an investment

- Choose a brokerage account

- Fund your account

Investment option

- Stocks

- Bonds

- Mutual funds

- Exchange-Traded Funds

- Index Funds

- Real Estate investment trusts

- Commodities

- Currencies

- Cryptocurrencies

- Alternative Investments

Investment Platforms

- Online Brokerages

- Robo-Advisors

- Financial Advisors

- Investment Apps

Key consideration

- Risk management

- Diversification

- Fees and commissions

- Tax implications

- Regular portfolio rebalancing

- Long-term perspective

- Research and due diligence

- Emergency fund in place

Investment strategies

- Dollar-cost averaging

- Value Investing

- Growth investing

- Dividend Investing

- Index investing

- Sector rotation

- Technical analysis

- Fundamental analysis

Monitoring an adjustment

Regularly review portfolio performance

- Rebalancing portfolio as needed

- Adjust investment strategy

- Stay informed about market trends

- Consult with financial advisors

It is an excellent idea. A simulator allows you to:

- Practice trading:

Check your strategies and ideas in a risk-free environment.

- Gain experience:

Enhance your skills and gain confidence in your trading decisions.

- Test theories:

Validate your theories and refine your approach.

- Introduce yourself with platforms:

Get easier with trading software and tools.

- Decrease risk:

Avoid costly mistakes and decrease potential losses.

- Improve discipline:

Understand a trading routine and focus on your strategy.

- Enhance knowledge:

You learn from your successes and failures in a simulated environment.

- Improve risk management:

Develop and check risk management techniques.

- Stay connected with market conditions:

Exercise trading in different market tasks.

- Build confidence:

Steadily move to live trading with a proven strategy and increased confidence.

Simulation:

Simulation is not a source of real-world experience, but it’s an excellent way to prepare and decline risks before investing original capital.

Simulator Common nowadays:

- Risk-free environment:

Simulators permit you to exercise trading without risking real money.

- Gain experience:

It helps you gain experience and improve your trading skills.

- Test strategies:

That ensures you to test and improve your trading strategies.

- Build confidence:

This type of simulator helps you to build confidence in your trading decisions.

- Analysis of market dynamics:

Simulators help you to understand market dynamics and how many tasks affect prices.

- Learn from mistakes:

Allow you to learn from mistakes without incurring real losses.

- Improve discipline:

You develop discipline and focus in your trading plan.

Popular trading simulator:

Stock and equities simulator

- Investopedia’s stock simulator> A free, web-based simulator with real-time data.

- Thinkorswim by TD Ameritrade> A professional trading platform with paper trading.

- Fidelity’s virtual trading

- E-Trade’s virtual trading

- Ally invests in trading simulator

Forex Simulator

- Meta trader’s strategy tester> Backtest and optimize Forex trading strategies.

- Ninja trader’s forex simulator> practice trading with real-time data.

- FXCM’s trading simulator> develop and refine Forex trading strategies.

- OANDA’s fx Trade Practice Account.

- IG’s Forex demo account.

Options and futures simulators

- Thinkorswim’s option simulator> practice option trading

- Ninja’s Traders futures simulator> simulate futures trading

- CME Groups trading simulator> practice trading futures and options.

- Interactive Broker’s paper trading.

- Trade stations simulation trading.

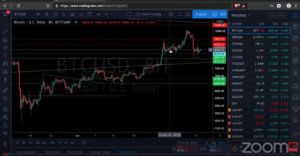

Cryptocurrency Simulators

- Coinbase’s Mock trading> Practice trading cryptocurrency.

- Binance’s demo trading> Simulate cryptocurrency trading.

- Crypto trader’s back-testing simulator.

- Trading views paper trading.

- ETORO’s virtual portfolio.

Mobile Apps

- Stock Simulator

- Trading simulator

- Investopedia’s stock simulator

- Thinkorswim Mobile

- Meta trade mobile

These simulators offer many features, including:

- Real-time data

- Virtual funds

- Customizable scenarios

- Backtesting

- Strategy optimization

- Performance analysis

- Risk management tools

Best way to test your strategy

In MT4 you can back-test your indicators and expert advisors through the strategy tester using a Free Trading Simulator. This is the best way to test your strategy because you can simulate trading sessions and feel the emotional pull when the market goes against you only to actually go to your profit target.

Can I practice investing with fake money?

In paper trading, the real money is not at risk. It is a complete form of simulated trading. It can become a good way for new traders who gain experience and construct their trading strategies.

Stock market simulators:

They are online programs that order investors to exercise their stock-picking arts without investing real money. In a correction territory business, we learn all the strategies for investing in real money.

By using a simulator, you can:

- Decline the risk of losing money

- Increase your chances of success

- Get valuable experience and insights

- Enhance your trading skills and information

- Make more informed investment decisions

They can help you prepare and reduce the risks associated with investing in real money.

Grasping the Significance of Recreation

Risk The board: Digital currencies are known for their unpredictability. Costs can swing emphatically in brief periods, which can prompt significant additions or misfortunes. A test system permits possible financial backers to encounter these vacillations without the gamble of losing genuine cash.

Methodology Improvement: Each financial backer has an exceptional system. Test systems give a stage to test these methodologies progressively in economic situations. This can assist financial backers with understanding which procedures line up with their monetary objectives and change resilience.

Experience with the Market: The digital money market works all day, every day, and can be affected by different factors like mechanical changes, administrative declarations, and worldwide financial occasions. Test systems assist financial backers with getting comfortable with what these variables mean for costs.

Mental Readiness: Managing genuine cash includes feelings like apprehension and eagerness. A test system permits financial backers to foster the mental strength expected to explore these feelings.

Sorts of Test systems

Online Test Systems: These test systems are open through internet browsers and require no downloads. They are great for clients who need speedy admittance to recreation with no specialized arrangement. it is also known as simulator trading or paper trading. It allows you to practice investing with virtual money in a realistic and risk-free environment.

Portable Applications: Numerous digital money trades and monetary instruction stages offer test system applications. These are advantageous for clients who like to deal with their speculations in a hurry.

Programming-Based Test Systems: These require downloading and introducing programming on a PC. They frequently offer further developed elements and customization choices.

Trade Test systems: Some digital money trades offer a “demo” account highlight, permitting clients to exchange with virtual cash in a live market climate.

Picking the Right Test System

1. Authenticity: The test system ought to intently mirror genuine economic situations. This incorporates the accessibility of different cryptographic forms of money, market liquidity, and cost vacillations.

2. UI: An easy-to-use connection point is essential for fledglings. The test system ought to be instinctive and give simple admittance to fundamental highlights.

3. Instructive Assets: A few test systems offer instructive materials, like instructional exercises and online courses, to assist clients with understanding how to utilize the stage and foster successful exchanging procedures.

Input and Examination: Search for test systems that give definite investigation and criticism on your exchanging execution. This can assist you with grasping your assets and shortcomings.

Security: Guarantee the test system is secure and safeguards your data. The test system should not need delicate data like bank subtleties. It would be safe from anything false data or information.

Augmenting Your Recreation Experience

Put forth Clear Objectives: Before beginning, characterize what you need to accomplish with the test system. This could be grasping the market, testing another technique, or creating risk to the executive’s abilities.

Begin Little: Start with little, straightforward exchanges to figure out the stage and the market elements. It is necessary to start with little because of market trends.

Explore different avenues regarding Various Systems: Utilize the test system to test different exchanging methodologies. This could incorporate day exchanging, swing exchanging, or long-haul financial planning.

Examine Your Exhibition: Consistently survey your exchange history and execution. Search for examples and areas of progress.

Draw in with the Local area: Numerous test systems have a local area of clients who offer tips and techniques. Drawing in with this local area can give important experiences and backing.

Stay aware of Market News: Utilize the test system related to certifiable news and market investigation. This assists in understanding what outside factors with meaning for the market. So stay aware of market news in test system.

Moving from Recreation to Genuine Money management

1. Assess Your Exhibition: After investing adequate energy in the test system, assess your presentation. If you’re reliably creating virtual gains, you might be prepared to put away genuine cash.

2. Begin with Little Ventures: Regardless of whether you’ve been effective in the test system, it’s wise to begin with little interest in the genuine market. This aids in slowly adjusting to the genuine economic situations and overseeing chances.

3. Learn: The market is continuously advancing. Keep learning and adjusting your techniques given your encounters and new data. learning data is an important key function of test system.

4. Use Apparatuses Admirably: As you progress to genuine speculations, utilize devices like stop-misfortune orders and portfolio trackers to deal with your ventures.

Remain Sincerely Grounded

Recollect that genuine cash is in question. Remain restrained and try not to settle on indiscreet choices because of feelings.

Involving a test system before putting genuine cash in digital currencies is a reasonable methodology for both fledgling and experienced financial backers. It gives a gamble-free climate to figure out the market, create and test systems, and construct the profound grit important for genuine exchanging. By choosing the right test system and connecting effectively with the cycle, financial backers can essentially improve their odds of coming out on top in the unstable and frequently flighty universe of digital currencies. Likewise, with any venture, nonstop learning and variation are vital to exploring the intricacies of the market and accomplishing long-haul monetary objectives.