The Monetary Trade Capitalization

The monetary trade capitalization, much of the time insinuated as a stock market cap, is a key estimation used by monetary patrons to take a look at the size and valuation of public partnerships. In this article, we’ll jump into what monetary trade capitalization is, the means by still up in the air, why it affects monetary benefactors, and its significance in looking at the overall monetary trade.

What is Monetary Trade Capitalization?

The article would start by getting a handle on the possibility of monetary trade capitalization, describing it as the total market worth of an association’s striking offers. It would detail the recipe for registering market cap, which incorporates expanding the continuous proposition cost by indisputably the number of uncommon offers.

Understanding Business Area Cap Classes

The article will discuss the three essential groupings of market capitalization: little cap, mid-cap, and tremendous cap stocks. It would get a handle on the general characteristics of every grouping and how they address associations of different sizes and extraordinary stages.

Significance of Market Capitalization

Next, the article will feature why market capitalization is significant for financial backers. It would make sense to how market cap mirrors an organization’s size, impacts its gamble profile and development potential, and influences its weighting in securities exchange files.

Looking at Organizations and Areas

The article will examine how financial backers use market capitalization to think about organizations inside a similar industry or area, as well as to break down the creation and execution of various areas inside the securities exchange.

Constraints and Contemplations

The article would address a few restrictions and contemplations related to market capitalization, for example, its dependence on stock costs, potential contortions brought about by share buybacks or weakening, and the requirement for extra measurements to give an extensive examination of an organization’s valuation.

Financial Exchange Capitalization

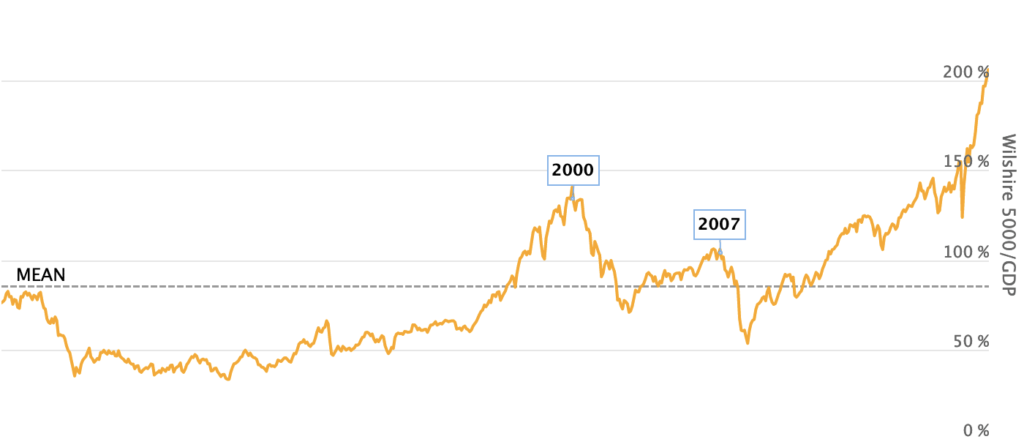

The financial exchange capitalization to Gross domestic product proportion, otherwise called the Buffett Marker, is an action used to assess the general valuation of a nation’s financial exchange compared with its Gross domestic product. Starting around my last update in January 2022, the proportion for the US was generally high, showing that the securities exchange was somewhat exaggerated contrasted with the size of the economy. Nonetheless, this proportion can vacillate over the long run because of changes in market valuations and financial development.

The Central Bank

For the most dependable and cutting-edge data on the securities exchange capitalization to Gross domestic product proportion for the US, I suggest looking at solid monetary sources like the World Bank, the Central Bank, or unmistakable monetary news sites. They typically give routinely refreshed information on monetary pointers like this one.

The financial exchange capitalization-to-gross domestic product proportion is a proportion used to decide. If the valuation proportion falls somewhere in the range of half and 75%, the market can be supposed to be humbly underestimated.

The proportion can be determined for a particular market

The financial exchange capitalization-to-gross domestic product proportion alludes to a metric that is utilize to assess whether a given market is esteemed precise as per its verifiable normal. The proportion can be determine for a particular market, for example, the London Stock Trade (LSE), or could be applied to the worldwide market. It is determined by separating the securities exchange capitalization of an economy by the total national output of that area.

Numerical Articulation for Financial exchange Capitalization-to-Gross domestic product Proportion

The financial exchange capitalization-to-gross domestic product proportion is communicated in a proportion or a rate structure and is determined utilizing the accompanying recipe:

Market Capitalization to Gross domestic product = (SMC/Gross domestic product) * 100

Where:

SMC – Financial exchange capitalization

Gross domestic product – GDP

Market Record

The complete worth of all the public stocks in the US can be determine utilizing the Wilshire 5000 Absolute Market Record. The list addresses the complete worth of the multitude of stocks in US monetary business sectors.

Deductions from the Securities exchange Capitalization-to-Gross domestic product Proportion

The securities exchange capitalization-to-gross domestic product proportion is a specialization. the proportion of the worth of all the openly record supply of all organizations in a given economy separate by the GDP of that economy. By and large, to the worth of the all-out yield delivered by that economy in a given period. It gives that level of Gross domestic product that is illustrative of the worth of the financial exchange.

By and large, in a circumstance when the proportion. If more prominent than 1, or 100 percent, it suggests that the market is as of now exaggerated. Then again, when the proportion is less than 0.5 or half, it shows that the load of that economy is underestimate. The verifiable normal of the US market is 0.5.

In a circumstance where the proportion falls anywhere between 0.5 to 0.75 or half to 75%, it is express that at the ongoing second. The market is precise or unobtrusive esteemed.

Factors that Affect the Securities exchange Capitalization-to-Gross domestic product Proportion

Market Cap to Gross Domestic Product

Portion of organizations that are public rather than the quantity of privately owned businesses in the economy. Additionally, patterns in the underlying public contributions of recently opened organizations likewise influence the worth of the proportion.

Functional Model

Consider a model where the all-out worth of the US financial exchange is $15 trillion. The country’s genuine quarterly Gross domestic product is $26 trillion. The market cap to Gross domestic product proportion would be roughly 1.66 (25 trillion/15 trillion). It would imply that the financial exchange. Is as of now exaggerated, considering that 166% of the Gross domestic product addresses the securities exchange esteem.

What is Ostensible versus Genuine GDP (Gross domestic product)?

Ostensible GDP (Gross domestic product) and Genuine. The gross domestic product measures the complete worth of all merchandise delivered in a country in a year. In any case, genuine Gross domestic product is adapt to expansion, while ostensible Gross domestic product isn’t. Consequently, genuine Gross domestic product is quite often somewhat lower than its comparable ostensible figure. As a rule, the genuine Gross domestic product shows a more precise image of a country. Financial exhibition since it tends to be all the more handle contrast with past figures. In this manner, we can find whether a nation truly is better or more regrettable off year over year.

How is Genuine Gross domestic product Determined?

To work out genuine Gross domestic product. We should limit the ostensible Gross domestic product by a Gross domestic product deflator. The Gross domestic product deflator is a proportion of the value levels. New merchandise that is accessible in a country’s homegrown market. It incorporates costs for organizations, the public authority, and confidential shoppers. The Gross domestic product deflator eliminates expansion from the situation. It empowers us to look at the Gross domestic. Product of a new year as the Gross domestic product of an objective year.

The Capitalization-Weighted List is a financial exchange. File in which every part of the list is weight compared with its all-out market capitalization. In a capitalization-weighted file, organizations with bigger market capitalization apply a more noteworthy effect on the record esteem.

Separating the Capitalization-Weighted File

The records additionally consider the investor base of every part.

Since certain organizations own portions that are not completely accessible to the general. Society most of the lists utilize the free float component to change estimations. The free float is the level of the offers accessible for exchange.

A few financial backers condemn capitalization-weighted records for giving a twisted perspective on the securities exchanges. Many accept that the essential justification behind the mutilation is the overweighting toward organizations with the biggest market capitalization.

Financial exchange Capitalization

To Gross domestic product Proportion in the US: A Top to bottom Examination

The monetary trade capitalization to GDP extent, much of the time implied as the market capitalization-to-GDP extent, is an immense money-related pointer used to check the general size of a country’s protections trade diverged from its overall financial outcome. This extent is particularly relevant for monetary patrons, policymakers, and market experts as it offers encounters into the prosperity, improvement, and improvement of a country’s money-related business areas. For the US, this estimation gives a window into the cooperation between money-related business areas and monetary turn of events.

Figuring out Market Capitalization to Gross domestic product Proportion

The market capitalization-to-GDP is not entirely set in stone by isolating the total market capitalization of a country’s protections trade by its Gross domestic product (GDP). Market capitalization implies the full-scale worth of all open proposals in a, not entirely set in stone by copying the deal cost by the total number of uncommon offers. GDP tends to the hard and fast worth of all work and items conveyed inside a country over a specific period.

This proportion gives a feeling of how huge the financial exchange is compared with the economy. A high proportion could recommend an advanced monetary market, while a lower proportion could demonstrate a more modest or less created securities exchange.

Verifiable Setting for the US

By and large, the market capitalization-to-gross domestic product proportion for the US has shown huge changes. In the last part of the 1990s and mid-2000s, during the website bubble, this proportion flooded as innovation stocks took off. The proportion crested at more than 200% in 1999, mirroring a period when market values were significantly high compared with Gross domestic product.

Post the website crash and the 2008 monetary emergency, this proportion saw a decay as market capitalizations changed and Gross domestic product development was impacted by the worldwide financial slump. For example, as a result of the 2008 monetary emergency, the proportion dropped altogether as financial exchanges attempted to recuperate while Gross domestic product development was drowsy.

Ongoing Patterns and Suggestions

As of recent years, the market capitalization-to-gross domestic product proportion for the US has been strikingly high, frequently surpassing 150%. This raised proportion can be ascribed to a few elements:

Powerful Securities Exchange Execution

The U.S. financial exchange has encountered drawn-out times of development, driven by mechanical progressions, advancement, and financial backer confidence. Significant files like the S&P 500 and NASDAQ have arrived at record highs, adding to expanded market capitalization.

Monetary Development and Corporate Benefits

Solid corporate income and financial development have reinforced securities exchange values. Organizations in the U.S. have seen significant benefit development, which thusly has prompted higher stock valuations.

Low Financing Costs

Delayed low-loan fees have made values more alluring contrasted with bonds and other fixed-pay speculations. This has driven greater interest in the securities exchange, expanding its capitalization compared with Gross domestic product.

Expanded Market Support

The development of speculation vehicles like trade exchange reserves (ETFs) and the ascent of retail financial backers have extended the market, adding to higher capitalization.

Deciphering the Proportion

A high market capitalization-to-gross domestic product proportion can show various things:

Market Overvaluation

An exceptionally high proportion could propose that the securities exchange is exaggerated compared with the economy. Financial backers ought to be careful of possible rectifications or market slumps assuming valuations are essentially confined to monetary basics.

Monetary Market Improvement

A high proportion frequently mirrors an advanced and mature monetary market.

Financial Wellbeing

A high proportion doesn’t be guaranteed to suggest monetary insecurity. As a rule, it can coincide with areas of strength for a developing economy, where high corporate benefits and financial backer certainty drive securities exchange valuations.

On the other hand, a low proportion could show immature monetary business sectors or less financial backer trust in the securities exchange. It could likewise mirror a nation’s emphasis on different types of monetary development, like confidential venture or elective funding techniques.

Worldwide Examinations

When thought about globally, the U.S. reliably has one of the greatest market capitalization-to-gross domestic product proportions on the planet. This is generally because of its huge and expanded securities exchange, the unmistakable quality of major worldwide enterprises, and a monetary framework that upholds elevated degrees of value venture.

Developing business sectors ordinarily have lower proportions because of less experienced securities exchanges and a higher extent of financial movement not reflected in public corporations. For example, nations like China and India have lower proportions, mirroring their somewhat less created value markets.

Suggestions for Financial backers and Policymakers

For financial backers, a high market capitalization-to-gross domestic product proportion requires cautious investigation of economic situations and valuations. It very well might be reasonable to survey whether high valuations are legitimate by monetary essentials or on the other hand assuming that they signal potential market amendments.

Policymakers utilize this proportion to check the strength of the monetary area and to arrive at informed conclusions about administrative measures. An extremely high proportion could incite conversations about market solidness and the expected requirement for administrative acclimations to moderate foundational chances.