Companies are Selected for the S&P 500

The Norm and Unfortunate’s 500, or S&P 500, is a record of the 500 greatest public firms in the US that is weighted by market capitalization. It’s perhaps of the most watched value lists, planned to address the securities exchange’s general presentation.

There are different variables thought about while picking which organizations to remember for the S&P 500.

Market Worth of value:

The complete market worth of an organization’s extraordinary portions of stock is known as market capitalization, and it is the primary standard. By and large, the S&P 500 contains probably the greatest American partnerships concerning showcase capitalization.

Liquidity:

Organizations should have the option to trade their portions on the financial exchange with adequate liquidity. By doing this, financial backers can easily buy and sell imparts without hugely affecting the stock cost.

Financial practicality:

Organizations need to have brought in cash for the last four quarters added together, as well as in the latest quarter. Moreover, they should meet a base necessity for public float: the level of remarkable offers open for public exchange.

Industry Portrayal:

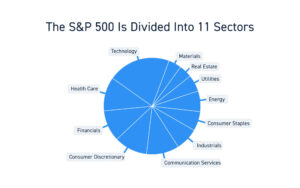

A wide assortment of areas inside the American economy are planned to be addressed by the record. Therefore, organizations from a scope of ventures are addressed, including innovation, medical care, finance, customer merchandise, and enterprises.

Financial Soundness and Control:

Organizations need to have a history of sound monetary administration as well as corporate administration methods that comply with severe rules. This covers things like following lawful commitments and bookkeeping straightforwardness.

Business Home:

Organizations should be legally framed in the US or one of its regions to be viewed as domiciled in the US.

The S&P 500 is overseen by S&P Dow Jones Records, which likewise inspects and changes the file’s synthesis consistently to ensure it keeps on being characteristic of the market all in all. Because of alterations to their market capitalization, monetary execution, or other relevant factors, organizations might be added to or eliminated from the list.

How are the S&P 500 firms picked?

To be recorded among the S&P 500 is a recognized accomplishment for significant American enterprises. This is how they are chosen.

Getting together Fundamental Circumstances: Organizations need to meet market cap, tradability, and public proprietorship benchmarks for their size and liquidity. They should likewise be recorded on a huge trade, productive, and zeroed in on the US market.

At record highs in the business sectors would it be a good idea for me to purchase stocks?

In 2024, three significant securities exchange files accomplished new highs. Furthermore, if you contribute at the top or lower part of the market, it could feel risky following quite a long while of market unpredictability, a pandemic, and international turmoil.

If you have any desire to make interest in an S&P 500 ETF:

Remember that ETFs have an offer cost and exchange in basically the same manner as stocks. You can buy fragmentary offers for any dollar sum, or you can follow through on the full offer cost, contingent upon your representative.

ETFs like file reserves regularly have cost proportions so make certain to check how much expenses are related to putting resources into a specific ETF.

While putting resources into stocks that are essential for the S&P 500 file, remember that stock costs change enormously. In the S&P 500, a couple of stocks are assessed under $100, while others are esteemed at $500 or more per share. Before choosing whether or not to buy, make a point to check the offer cost of each stock.

Normal Resources:

Around the completion of every single day, the market capitalizations for the included still hanging out there. The hard and fast float-changed market capitalization of all S&P 500 stocks is then divided by an elite rundown divisor to deduce the end worth of the record. Because of this method, the S&P 500 is overwhelmingly weighted to lean toward associations with a higher market cap.

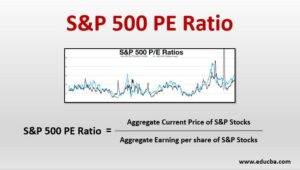

An intriguing focus while considering how the S&P 500’s expense will move to integrate factors, for instance, association benefit per share, pay, huge news including the associations recorded on the exchange, monetary data, major political events, and credit charges. Besides, there are many times a thump in share cost when an association is added to the S&P 500 because normal resources need to purchase the stock if they wish to address the document definitively.

One significant component is market capitalization:

Since the S&P 500 is intended to address the greatest American organizations, size is an essential component. All in this occurrence, the organization’s size is directed by its portion cost. Securities exchange esteem, which is the amount of the upsides of its exceptional offers.

Coca-Cola, for example, presently claims around 4.3 billion portions of extraordinary stock. At the hour of composing, the offer cost is $49. Subsequently, its market capitalization is generally $210 billion.

The S&P 500 edge varies over time, with $6.1 billion filling in as far as possible as of this moment. That number was significantly lower a long time back, and you would expect it to be a lot higher a long time from now.

What is the S&P 500 Record?

The Norm and Unfortunate’s 500 Record, shortened as the S&P 500 file, is a list containing the supplies of 500 public corporations in the U.S. with the most elevated upsides of market capitalization. Market capitalization, or market cap, is the result of the quantity of extraordinary portions of an organization and its portion cost.

How Might You Make the S&P 500 Rundown?

The S&P 500 list will in general be a good measure of the tremendous US market capitalization. Large-cap stocks allude to organizations that have a market worth of around $10 billion. Considering that medication organizations represent 5% of the US huge cap market, these organizations will be recollected to a comparable degree on the rundown.

S&P 500 could mean for you:

If you own singular huge-cap stocks. You may almost certainly put resources into at least one organization recorded on the file. Many list-based shared assets and trade exchanged reserves contribute to following or mirroring the S&P

yearly exhibition and own every one of the 500 of the file’s stocks. Furthermore, because it has such wide openness across areas. The file is a helpful benchmark, offering bits of knowledge on the general strength. The business sectors and the economy.

An update:

All ventures convey risk and are likely to test conditions, including times of elevated. Market unpredictability, for example, what we saw in 2022, he notes. Nor should financial backers center exclusively around the S&P 500. Supplies of more modest, promising organizations and worldwide values can offer significant potential learning. Experiences for financial backers. while bonds and different resources are fundamental for expansion.

Primary concern:

While there will constantly be instability results might differ from one year. McGregor accepts that S&P 500 organizations will keep on offering significant advantages for financial backers. “Given their further developing efficiency, demonstrated strength. More excellent and consistent profit development, we accept this gathering. Organizations ought to be considered as a center holding for long-haul financial backers.

The S&P 500, one of the most striking monetary trade documents, is made from 500 of the greatest public partnerships in the U.S. Furthermore, fills in as a basic benchmark for the overall show of the U.S. monetary trade. The decision cycle for associations to be associated with the S&P 500 isn’t simply considering size alone anyway incorporates an extent of models planned to ensure that the rundown reflects a wide, stable cross-part of the American economy. This expansive methodology ponders an association’s market capitalization, liquidity, home, public float, region depiction, and financial achievability.

Understanding the choice interaction gives knowledge into the elements of the U.S. economy and the job that these organizations play in molding market patterns.

Market Capitalization

Market capitalization is maybe the most major rule for consideration in the S&P 500. It alludes to the all-out worth of an organization’s exceptional portions of stock, determined by increasing the offer cost by the all-out number of offers. Starting around 2024, the base market capitalization prerequisite for an organization to be considered for the S&P 500 is roughly $14.5 billion. This edge guarantees that enormous, persuasive organizations are remembered for the file, as these organizations are probably going to altogether affect the general market.

While huge cap organizations rule the S&P 500, more modest records like the S&P MidCap 400 and S&P SmallCap 600 track medium- and little-measured organizations. Organizations might move on from these more modest files to the S&P 500 as they fill in size and significance inside the market.

Liquidity and Exchanging Volume

One more key necessity for consideration in the S&P 500 is liquidity, which alludes to how effectively an organization’s stock can be traded without causing a critical effect on its cost. High liquidity is vital because the S&P 500 is a broadly involved record for speculation items like shared assets and trade exchanged reserves (ETFs), and that implies there should be adequate exchanging action to oblige huge scope trading by institutional financial backers.

The liquidity prerequisite is regularly estimated by exchanging volume, which mirrors the quantity of offers exchanged over a given period. Organizations should have an elevated degree of liquidity, guaranteeing that their stock can be exchanged effectively and in enormous amounts without critical cost variances. S&P Dow Jones Files normally expect that the stock be effectively exchanged, with somewhere around half of the organization’s portions accessible to people in general (known as the public float).

Home and U.S. Center

Just associations domiciled in the US are equipped for thought in the S&P 500. The association ought to in like manner record its money-related reports with the U.S. Assurances and Exchange Commission (SEC), ensuring that it follows U.S. money-related itemizing standards and rules. This is critical because the S&P 500 is supposed to reflect the U.S. protection trade, and the fuse of associations that work under different authoritative frameworks could disrupt the rundown’s credibility and similarity.

Notwithstanding home, the organization should have a critical piece of its income produced inside the US. Albeit numerous S&P 500 organizations are worldwide and get incomes from worldwide tasks, most of their business exercises ought to be established in the U.S. economy. This guarantees that the record stays in serious areas of strength for a homegrown market.

Productivity and Monetary Feasibility

An organization’s monetary well-being is likewise viewed as in the determination cycle for the S&P 500. To meet all requirements for consideration, an organization should be productive, as estimated by its latest quarters of monetary outcomes. In particular, the organization probably revealed positive profit in the latest quarter. As well as in the amount of its four latest quarters. This guarantees that the S&P 500 remains an assortment of monetarily sound organizations with solid profit potential, making it an appealing file for financial backers.

The advisory group that administers the file considers area balance while settling on conclusions about which organizations to add or eliminate. This guarantees that no single area rules the file and that the S&P 500 mirrors. The general synthesis of the U.S. economy. For instance, although the innovation area has filled considerably. Lately, the S&P 500 incorporates critical portrayal from additional customary. Areas like industrials and shopper products.

Public Float

Public float alludes to the level of an organization’s portions that are accessible for public exchange, instead of those held by insiders like organization leaders or enormous institutional financial backers. The S&P 500 expects organizations to have no less than half of their portions accessible for public exchange. This is significant because a higher public float by and large implies that an organization’s stock. Is all the more broadly held and exchanged, adding to the liquidity of the stock.

A low open float could imply that few investors hold critical command over the organization, making valuing control or enormous fluctuations in stock more inclined. In this manner, by upholding a base public float necessity, the S&P 500 guarantees that the organizations in its record have a wide investor base and are less helpless to showcase unpredictability brought about by concentrated possession.

Changes to the File

The organization of the S&P 500 is evaluated routinely by a board of trustees at S&P Dow Jones Records, which makes changes as important to guarantee that the list keeps on mirroring the U.S. economy. Changes to the file happen when organizations are added or eliminated in light. Of their capacity to meet the determination models. For instance, on the off chance that an organization is gained by another firm, seeks financial protection. Encounters a huge decrease in market capitalization, it could be taken out of the file.

Essentially, if an organization fills in size and noticeable quality, meeting the standards for consideration, it very well might be added to the S&P 500. Organizations may likewise be eliminated assuming their area is overrepresented, accounting for the better possibility of guaranteeing the record’s equilibrium.