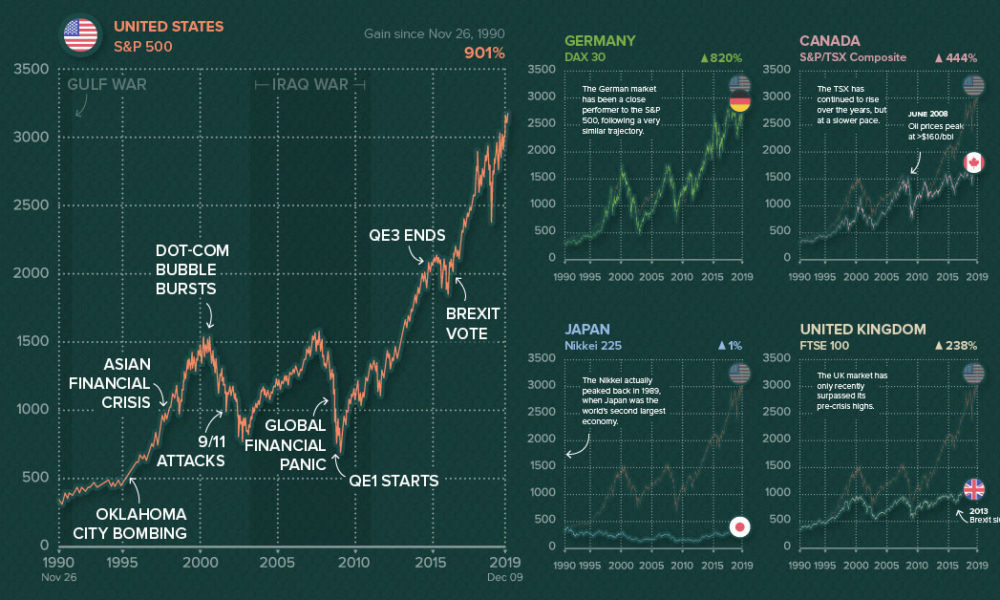

Major Stock Market Indices Worldwide

Significant financial exchange files act as marks of the presentation of a portion of the financial exchange or the market all in. Here are the absolute most unmistakable financial exchange lists around the world.

Dow Jones Modern Normal (DJIA)

Contains 30 significant, freely claimed organizations situated in the US. S&P 500Consolidates 500 of the greatest associations kept on stock exchanges in the US.

NASDAQ Composite

Encompasses all of the stocks recorded on the NASDAQ stock exchange, known for its high gathering of advancement associations.

FTSE 100 (UK)

Locations of the 100 greatest associations recorded on the London Stock Exchange by market capitalization. Tracks the display of 30 huge German associations trading on the Frankfurt Stock Exchange. Integrates 40 of the greatest and most liquid associations on the Euronext Paris exchange. A blue-chip document tending to 50 of the greatest associations in the Eurozone.

Nikkei 225 (Japan)

Contains 225 gigantic, transparent associations arranged in Japan.

Shanghai Composite Document (China)

Tracks all stocks (An offers and B shares) recorded on the Shanghai Stock Exchange.

Hang Seng Document (Hong Kong)

Consolidates 50 of the greatest associations recorded on the Hong Kong Stock Exchange.

S&P BSE Sensex (India)

A monetary trade document of 30 profoundly grounded and financially sound associations recorded on the Bombay Stock Exchange.

Various Regions

Integrates 200 of the greatest associations recorded on the Australian Securities Exchange.

TSX Composite (Canada): Locations around 250 of the greatest associations on the Toronto Stock Exchange.

Bovespa (Brazil): Contains around 70 of the greatest and most successfully traded stocks on the São Paulo Stock Exchange.

These records give a depiction of market drifts and are generally utilized by financial backers to measure the strength of the securities exchanges and go with informed speculation choices.

What is a Securities Exchange Record?

A securities exchange record, otherwise called a stock file, gauges a segment of the securities exchange. As such, the record estimates the adjustment of the offer costs of various organizations.

The stock is not set in stone by computing the costs of specific stocks (for the most part a weighted normal). It is a device generally utilized by monetary establishments and financial backers to look at the profit from explicit ventures and to portray the market.

Sorts of Securities Exchange Files

Financial exchange files might be grouped in various ways. A “worldwide” or “world” financial exchange file contains stocks from different locales like the MSCI World or the S&P Worldwide 100. Areas can be characterized topographically (for instance, Asia, Europe) or by levels of pay or industrialization (for example, outskirts markets, created markets).

A public list addresses the exhibition of the securities exchange of a clear nation and mirrors the opinion of financial backers on the economy’s condition. Public records incorporate the loads of huge organizations recorded on the country’s biggest stock trades. Numerous files are provincial the FTSE Created Asia Pacific Record or the FTSE Created Europe List.

More particular lists track the presentation of explicit areas of the securities exchange. In the US, particular records incorporate the Morgan Stanley Biotech List, which comprises 36 American organizations in the biotechnology business, and the Wilshire US REIT, which tracks more than 80 U.S. land venture trusts. Other records might screen associations of a specific size or sort of board.

The Significance of Lists

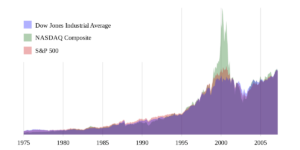

The everyday aftereffects of securities exchange files are maybe the most famous and huge numbers in the entire universe of money management and money. Presumably the world’s most popular and most broadly utilized financial exchange file, the Dow Jones Modern Normal (DJIA) comprises of 30 biggest exchanged organizations in the US.

Numerous financial backers

Numerous financial backers use market lists for dealing with their venture portfolios and following the monetary business sectors. Lists are profoundly incorporated into the venture the board business, and assets use them as benchmarks for execution correlations.

Files as Benchmarks

Records go about as benchmarks for different purposes in the financial business areas. As referred to, the Dow Jones Present day Typical, Nasdaq Composite, and S&P 500 are the three most notable U.S. records. The three records contain the 30 greatest stocks in the U.S. by market capitalization, all stocks on the Nasdaq Exchange, and the 500 greatest stocks, independently. Benchmarks can be a respectable sign of the overall U.S. monetary trade since they consolidate presumably the main U.S. stocks.

Financial backers can likewise utilize execution and benchmark values to follow speculations by sections. A few financial backers might enhance their venture portfolios in light of the profits or anticipated returns of specific fragments. Besides, a particular file might go about as a benchmark for a common asset or a portfolio.

Regardless of international strains

Regardless of international strains and an approaching downturn, monetary business sectors outperformed assumptions in 2023, with a considerable lot of the significant financial exchange files areas of strength for recording particularly all through the year’s end. Tech organizations connected to the improvement of computerized reasoning took off as devotee financial backers. Support the business, as would be considered normal to encounter solid development in the approaching 10 years. The most striking model is the U.S. tech organization Nvidia: the association’s portion cost soared in 2023, making it the third biggest organization overall in the innovation area regarding market capitalization. By and large, all financial exchange files finished the year with huge increases, notwithstanding vacillations or many organizations failing to meet expectations records throughout the year.

What is a financial exchange file?

A financial exchange file estimates the presentation of a section of the financial exchange. It is determined in light of the costs (and frequently market capitalization) of the organizations (or other hidden resources) which have a place with the file. A moment is relegated to a beginning worth (say, 0 or 100), with changes then, at that point, being estimated regarding this beginning worth. This permits the record to effectively show how a market has been created over the long run. One of the main stock records on the planet is the S&P 500, which estimates the presentation of 500 of the biggest U.S. organizations. With a beginning worth of 386.36 in 1957, by July 2023 the list had ascended to 4,472.16. Additionally, the Dow Jones Modern Normal (which incorporates 30 unmistakable U.S. organizations) developed from 40.94 in 1896 to 34,347.43 in July 2023.

What are the vitally stock files on the planet?

There are in a real sense a great many securities exchange files on the planet. Covering everything from the world economy overall, to sub-areas of public or neighborhood economies, to costs of other monetary. Resources like valuable metals. Besides the enormous two previously mentioned U.S. securities exchange records, probably the most renowned public. Files are the FTSE 100 (which incorporates. The biggest 100 U.K. organizations) and the Japanese Nikkei. Hong Kong’s Hang Seng (covering the 50 biggest organizations on the Hong Kong Stock Trade). And the German DAX (with the main 40 German organizations on the Frankfurt Stock Trade). These lists are viewed as bellwethers for the related public economy.

The worldwide securities exchange is a unique element made out of different files that mirror the exhibition of monetary business sectors in various nations and districts. Financial exchange files are urgent as they give a depiction of a specific market or area’s presentation, helping financial backers, examiners, and financial specialists evaluate patterns, distinguish venture valuable open doors, and look at the exhibition of various business sectors. Here, we will investigate a portion of the significant financial exchange records around the world, inspecting their importance, structure, and the economies they address.

Dow Jones Modern Normal

The Dow Jones Modern Normal (DJIA) is one of the most notorious and most established securities exchange files around the world, laid out in 1896. It tracks the presentation of 30 huge, freely claimed organizations situated in the US. The DJIA is a cost-weighted record, implying that organizations with higher stock costs impact the list’s developments. Regardless of its modest number of constituent organizations, the DJIA is in many cases thought about as a gauge of the general U.S. economy and the financial exchange’s well-being.

S&P 500 Record

The Norm and Unfortunate’s 500 Record (S&P 500) is another driving U.S. financial exchange file. It contains 500 of the biggest public corporations in the US and is viewed as one of the most amazing portrayals of the U.S. securities exchange all in all. The S&P 500 is market capitalization-weighted, and that implies that the size (still up in the air by the complete worth of their remarkable offers) decides its impact on the list. The S&P 500 consolidates associations from all areas, similar to advancement, clinical consideration, money-related organizations, client items, and energy. Huge organizations like Amazon, Letters all together (Google), ExxonMobil, and JPMorgan Seek after are fundamental for this record. Monetary benefactors look at the S&P 500 to check the strength of the greater U.S. economy, and various money-related things, including normal resources and exchange-traded holds (ETFs), rely upon this record.

The document integrates firms

From various regions, such as banking, oil and gas, medications, and mining. Key parts consolidate BP, HSBC, GlaxoSmithKline, and Unilever. As a result of the overall thought of an extensive parcel of the associations in the FTSE 100, the record shows can be affected by worldwide financial conditions, cash differences, and product costs, making it a supportive gadget for following not just the U.K. economy.

but also overall market designs. DAX 40 Germany The DAX (Deutscher Aktienindex) is Germany’s essential securities exchange file, following the 40 biggest organizations recorded on the Frankfurt Stock Trade. Like other significant files, the DAX is a market capitalization-weighted record. It is viewed as a check on the well-being of the German economy, the biggest in Europe. The DAX is vigorously weighted towards modern and assembling organizations, mirroring Germany’s monetary design. It incorporates notable firms like Siemens, Volkswagen, Bayer, and Deutsche Bank. Given Germany’s basic job in the European Association, the DAX is firmly watched by financial backers as a sign of more extensive European monetary patterns.

What is a financial exchange list?

To acquire a superior comprehension of a financial exchange list, one requirement is to figure out two terms: endlessly stock trade.

There are a large number of organizations in each country. A large number of these organizations raise the capital expected for their tasks by giving offers to the general population. A gathering of offers shapes a stock. By claiming a stock, a financial backer participates in the responsibility for the organization.

The public stage through which offers or stocks are traded is known as stock trades. In India, the Bombay Stock Trade and Public Stock Trade are the two significant stock trades.

A securities exchange record includes a gathering of stocks, recorded on the trade, that fall under a comparative class. It is illustrative of the general securities exchange and is a normalized measure to screen changes in the securities exchange. Besides, files help in following the economy of the world, country, or a particular area or industry bunch.

Any adjustment of the stocks is reflect in the exhibition of the list. Flooding stock costs lead to the ascent of the file while dropping stock costs makes the record tumble. Hence, financial exchange records assist financial backers with following the shifts in the general market course.

How to Ascertain the Worth of a File?

There are multiple ways used to compute the worth of a securities exchange file. We should investigate two normal strategies: The free-float market capitalization technique and cost weightage.

Free-float market capitalization technique:

In this technique, the ongoing worth of a file is the amount of free-float market capitalization of all stocks. Recorded in the list partitioned by the base year record esteem.

Free float is the number of portions of the organization that can be unreserve exchange. Free float, partitioned by the all-out shares, gives the organization’s free float factor. The free-float market capitalization is the result of the financial exchange. Value, the all-out number of offers, and the free float factor or essentially. The offer cost increased by the free float of the organization.

Cost-weighted record:

The worth of the record is acquired by partitioning the number of stock costs of each stock by the divisor, an erratic worth allotted by the list. The worth of the divisor is exposed to changes in light of underlying changes inside the file.

Dow Jones Modern Normal proposes this technique. Each stock in the record is relegated to its weightage because of its cost. The higher the stock cost, the higher the weightage and the more prominent the effect of its cost changes on the list.