Presidential Elections and the Stock Market

Investigation of financial exchange execution during political race years versus non-political race years. Verifiable information representing market developments and instability designs during political decision cycles.

Market Responses to Political Race Results

Assessment of how the securities exchange ordinarily responds to various political decision results. Contextual analyses of outstanding political race years and their effect on market feeling.

Monetary Strategies and Market Assumptions

Effect of proposed or carried out monetary strategies by official applicants on financial backer feelings and market patterns

Impact of financial arrangements (charge changes, government spending) and money-related approaches (loan costs, Central bank activities) on market elements during political decision years.

Sectoral Investigation and Execution

Area explicit execution during political decision cycles. Methodologies for financial backers to gain by sectoral potential open doors in light of political race results and strategy shifts.

Financial backer Opinion and Market Unpredictability

Job of vulnerability and financial backer opinion during political decision periods. Techniques for financial backers to oversee and use political decision-related market instability.

Worldwide Market Suggestions

Effect of U.S. official races on worldwide monetary business sectors and global financial backer feeling. Investigation of international variables and their effect on worldwide market solidness during political decision years.

Innovation Area

Verifiable execution of the innovation area during political race years. Effect of innovation strategies and administrative changes proposed by official up-and-comers. Contextual investigations of outstanding political decision cycles and their consequences for innovation stocks.

Medical care Area

Examination of medical services area execution comparable to political race results and medical services strategy changes. Impact of medical care approaches on drug, biotech, and medical care administrations stocks. Techniques for financial backers to explore medical care area instability during political race cycles.

Energy Area

Assessment of energy area execution during political decision years, taking into account energy arrangements and natural guidelines. Effect of energy autonomy approaches and sustainable power speculations on energy stocks. Contextual investigations of political race cycles influencing oil, gas, and sustainable power areas.

Monetary Administrations Area

Market responses to monetary guideline arrangements and banking changes proposed by official applicants. Execution of banking, protection, and monetary innovation (fintech) stocks during political decision cycles. Methodologies for financial backers in the monetary administration area amid administrative vulnerability.

Purchaser Merchandise and Retail Area

Purchaser feeling and spending designs during political race cycles. Effect of assessment approaches and customer security guidelines on retail and buyer products stocks. Techniques for financial backers to gain by shopper area potential open doors given political race results.

Modern and Assembling Area

Monetary improvement arrangements and framework spending’s effect on modern and assembling stocks. Investigation of exchange arrangements and worldwide production network elements impacting area execution. Contextual analyses of political decision years influencing aviation, safeguard, and assembling businesses.

Sectoral investigation

Rundown of sectoral investigation during official races and their suggestions for financial backers. Proposals for expanded venture procedures because of area explicit open doors and dangers.

Presentation

Significance of the shopper products and retail area in monetary pointers and financial backer portfolios. Outline of how official decisions impact buyer opinion and spending conduct.

Buyer Opinion and Spending Examples

Investigation of buyer opinion files during political race cycles. Effect of Political Vulnerability on Shoppers’ ways of managing money and Retail Deals. Contextual analyses of political decision years and their impacts on shopper certainty and retail area execution.

Charge Arrangements and Shopper Conduct

Impact of duty strategies proposed by official competitors on shopper buying power. Examination of what changes in personal duty rates and allowances mean for shopper spending at various levels of pay. Techniques for retailers to adjust showcasing and estimating systems in light of potential duty changes.

Administrative Changes and Shopper Insurance

Effect of shopper insurance guidelines and item security principles on retail stocks. Assessment of administrative changes proposed by up-and-comers and their suggestions for customer merchandise organizations. Contextual analyses of political decision cycles influencing administrative systems and shopper merchandise market elements.

Web-based business and Computerized Change

Development of web-based business and computerized retail stages during political decision years. Effect of Innovative Strategies and computerized foundation speculations on Internet-based retail stocks. Techniques for financial backers to exploit the shift towards computerized purchaser conduct during political race cycles.

Inventory network Elements and Worldwide Exchange Arrangements

Examination of worldwide production network disturbances and exchange arrangements affecting buyer merchandise costs and accessibility. Effect of Economic accords and taxes on retail area benefits and buyer valuing. Contextual investigations of political decision results influencing worldwide exchange and buyer products import/trade patterns.

Brand Faithfulness and Showcasing Procedures

The job of brand faithfulness and buyer trust in supporting retail area execution during political race cycles. Techniques for retailers to upgrade client commitment and brand dedication amid political vulnerability. Effect of political promoting and crusade informing on customer discernment and buying choices.

How do races influence the securities exchange?

General races influence securities exchanges. The vulnerability around their result ordinarily increments market instability before votes are projected. Showcases likewise keep on changing after a political decision happens as the arrangement needs of the recently introduced government become evident.

A reasonable edge of triumph and a returning occupant will generally lessen vulnerability and limit the unpredictability seen in financial exchanges.

Effectively anticipating political decision results is troublesome. Throughout the past ten years, surveyors, political experts, and journalists have made some striking estimating mistakes. One clear model is the 2016 US official political decision when assessments put the probability of Hilary Clinton succeeding somewhere in the range of 71% and close to 100%.

Monetary business sectors mirror this test. Without even a trace of an unmistakable agreement about the result, we see bigger day-to-day cost changes that will generally counterbalance one another. While these leave costs unaltered, generally speaking, they make enhanced market variances over the political decision period.

The size of the vacillations depends, to some degree, on the electing framework. Greater part frameworks – like the UK’s ‘first-past-the-post’ and the electing school in the US – where losing by 0.5% has a similar result as losing by 95%, are less unsurprising than corresponding portrayal frameworks. This can influence financial exchange returns altogether.

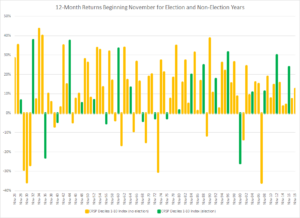

This trouble is clear in the uplifted unpredictability of offer costs during races. One investigation discovers that inside the 51 days encompassing races, securities exchange returns show over 20% higher instability than expected. In addition, the remuneration for bearing this chance is somewhat unassuming.

For what reason do securities exchanges care?

The connection between races and the economy has been known for quite a while. Work from the 1970s brought up that legislators frequently help the economy before decisions to acquire favor, just to circle back to intense measures like expansion control through higher loan fees a while later.

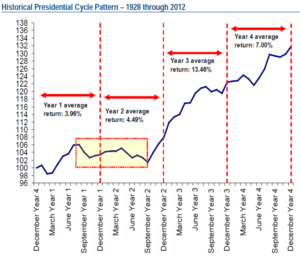

This might make sense of some drawn-out consistency in US securities exchanges. An investigation of how securities exchanges process data during electing cycles proposes that the market is to some degree wasteful because a few long-haul patterns were unsurprising (Allvine and O’Neill, 1980).

This work proposed an exchanging methodology of purchasing shares two years before US official races and selling presently before the political decision. The procedure outflanked a ‘purchase and hold’ technique by 3.4% each year for the period 1961-78. An ensuing report found comparable outcomes when information was refreshed to incorporate the mid-1990s.

There is proof to propose that not simply the planning of races influences securities exchanges but that the results matter as well. Despite the supposition that Money Road leans towards conservative administrations, proof recommends that securities exchanges generally perform better during Vote-based administrations.

Other work features that the response of a specific offer to political decision results will rely upon the duty strategies that might influence that organization and the business of which it is a section.

Official Races and the Financial Exchange

The connection between official races and the financial exchange is a subject of huge premium for financial backers, policymakers, and political experts. Markets are much of the time thinking about an impression of monetary feeling, and decisions can present significant vulnerability, as the strategies of various up-and-comers can have changed ramifications for financial strategy, tax collection, exchange, guideline, and government spending. Thus, this vulnerability influences the financial backer way of behaving. Understanding how official decisions cooperate with the securities exchange requires investigating a few variables, including verifiable examples, financial backer brain science, the expected impacts of political race results, and the more extensive monetary setting.

Authentic Examples of Market Execution

By and large, there is a discernment that the financial exchange lean towards specific political results, especially solidness. Financial backers by and large could do without vulnerability, and the possibility of a political race, particularly a nearby one, can increment unpredictability. In the months paving the way to an official political race, markets might encounter uplifted aversion to surveying information, crusade improvements, and other political race related news.

Pre-Political decision Market Conduct

Unpredictability: By and large, the securities exchange will in general show expanded unpredictability during political decision years, particularly in the months paving the way to the political decision. Vulnerability about the victor, and what their arrangements could mean for the economy, drives quite a bit of this unpredictability.

Effect of Surveys: As surveys shift and political decision results become less unsurprising, the securities exchange might respond as needs be. For instance, markets might revitalize when surveys show a supportive of business up-and-comer driving, while they might encounter declines when surveys propose a result leaning toward additional guideline or higher charges.

A few examinations propose a general pattern of positive securities exchange execution in the months paving the way to a political race, frequently credited to government spending increments and strategy choices expected to support financial movement before the vote. Nonetheless, this impact isn’t steady across all political decision cycles and may shift in view of the monetary setting.

Post-Political race Patterns:

Market Response to Political Decision Results

After the political decision, advertises ordinarily answer the lucidity that accompanies knowing the champ. In the event that the result is in accordance with assumptions, markets might balance out. Nonetheless, on the off chance that the outcome is unforeseen, markets might encounter extra instability as financial backers recalibrate assumptions.

Market Inclinations for Party: By and large, there has been banter about whether markets perform better under Equitable or conservative organizations. Conservatives are generally viewed as more business-accommodating, upholding for lower charges and less guideline, which is seen as sure for the securities exchange. Liberals, then again, frequently center around friendly government assistance and higher corporate expenses, which a few financial backers consider to be less positive. Notwithstanding, exact proof shows that financial exchange execution has serious areas of strength for been both Vote based and conservative presidents. For instance, the market performed extraordinarily well during the administrations of leftists like Bill Clinton and Barack Obama, yet it additionally saw critical increases under conservatives like Ronald Reagan and Donald Trump.

Financial backer Brain science and Political race Cycles

Financial backer brain science assumes a key part in what races mean for the securities exchange. The expectation of a potential strategy shift can make financial backers anxious, prompting market sell-offs or revitalizes in view of the apparent probability of various results. This conduct is frequently attached to a few critical mental elements:

Vulnerability Revolution

Vulnerability about the future, particularly with respect to financial arrangement, frequently prompts expanded unpredictability. This is especially evident in situations where a political race result might prompt significant arrangement shifts in regions like tax collection, guideline, and exchange. Financial backers ordinarily incline toward an anticipated business climate, so any competitor who guarantees progression might lessen market instability, while an up-and-comer who advocates for sensational change might increment it.

Preference for non-threatening information

Financial backers may likewise be inclined to a tendency to look for predictable feedback, where they decipher new data in a way that affirms their prior convictions. For instance, financial backers who anticipate that a specific competitor should be gainful for the economy might zero in on sure monetary markers during their mission, while making light of any regrettable signs.

Eruption to Transient News: Markets frequently blow up to momentary political news, particularly during a political race cycle. Titles about banter exhibitions, crusade discourses, or surveying information can prompt automatic responses, driving unexpected spikes or drops in stock costs, despite the fact that these momentary changes may not essentially influence the drawn out basics of the economy.

Financial Approach and Its Effect Available

The genuine strategies established by the president once in office assume a vital part in deciding securities exchange execution over the medium to long haul. Various organizations focus on various approach objectives, and these objectives can varyingly affect areas of the economy and, likewise, on financial exchange execution.

The More extensive Financial Setting

It’s essential to perceive that the securities exchange doesn’t exist in a vacuum, and the more extensive financial setting wherein a political race happens assumes a critical part in molding market responses. In the midst of monetary downturn, for instance, the market might respond all the more decisively to a political race result assuming it is seen that one applicant’s strategies will be more successful in prodding recuperation.

Downturns and Recuperations: Races held during monetary downturns, like the 2008 monetary emergency or the 2020 Coronavirus pandemic, will generally see more articulated market responses, as financial backers shift focus over to the approaching organization to direct the nation out of the slump. In these circumstances, markets might revitalize in the event that the chosen president is viewed as more fit for dealing with the recuperation, or they might decline assuming financial backers need trust in the approaching organization’s arrangements.