Stock Market Analysis Using Python

Securities exchange investigation is significant for settling on informed speculation choices. With the appearance of strong programming dialects like Python, leading inside and out securities exchange investigation has become more open. Python’s broad libraries and instruments make it an optimal decision for monetary examination and financial exchange expectations.

Significance of Securities Exchange Examination

Understanding business sector patterns and stock execution is fundamental for financial backers. Securities exchange investigation includes assessing a wide period of market information to foresee future cost developments, which can assist financial backers with choosing when to trade stocks.

Beginning with Python

To start a financial exchange examination with Python, you want to set up your Python climate and introduce the important libraries. On the off chance that you haven’t introduced Python,

Information Assortment

For the financial exchange examination, we want authentic stock information. The finance library permits us to download notable market information from Hurray Money. This is the way to get everything rolling:

Information Preprocessing

Information preprocessing includes cleaning and getting ready information for examination. This incorporates taking care of missing qualities, organizing information, and making new elements if fundamental.

Exploratory Information Examination (EDA)

EDA assists us with understanding the information better. We can imagine patterns, examples, and inconsistencies utilizing different plots.

Specialized Examination

The specialized examination includes concentrating on past market information to foresee future cost developments. Normal procedures incorporate Moving Midpoints and the General Strength Record (RSI).

Moving Midpoints

Moving midpoints smooth out value information to recognize patterns. The Straightforward Moving Normal (SMA) and Remarkable Moving Normal (EMA) are the two normal sorts.

Relative Strength List (RSI)

RSI is a forced oscillator that actions the speed and change of cost developments. It goes from 0 to 100, showing overbought or oversold conditions.

Representation

Representation assists in understanding the information with bettering. We utilize different plots to imagine stock costs, moving midpoints, RSI, and different pointers.

AI for Stock Expectation

AI can be utilized for prescient demonstrating. We’ll utilize a straightforward direct relapse model to foresee future stock costs.

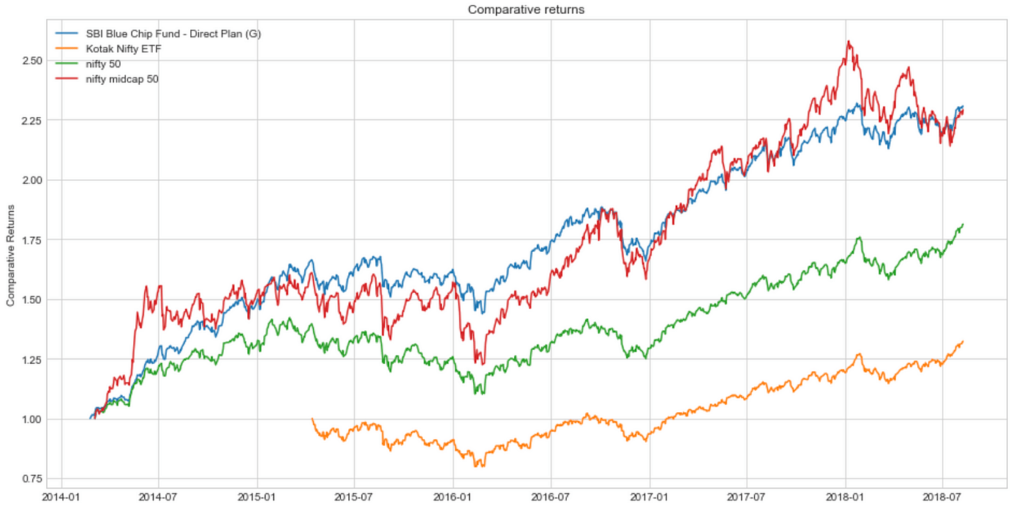

financial exchange investigation

Python is an amazing asset for financial exchange investigation, offering broad libraries and devices for information assortment, preprocessing, examination, and perception. By utilizing Python, financial backers can perform extensive securities exchange examinations and go with additional educated choices.

Python is an incredible language for making information-based investigations and perceptions. It likewise has a large number of open-source libraries that can be involved off the rack for a few incredible functionalities. Python Run is a library that permits you to fabricate web dashboards and information perceptions without the problem of complicated front-end HTML, CSS, or JavaScript. In this article, we will figure out how to construct a Stock information dashboard utilizing Python Run, Pandas, and Hurray’s Money Programming interface.

Make Stock Perception Dashboard involving Run in Python

We will make the dashboard for stock recorded on the New York Stock Exchange(NYSE). For making a dashboard we will require some Python libraries that aren’t preinstalled with Python. we will utilize the pip order to introduce this large number of libraries individually.

Introduce the most recent rendition of Run

The run is utilized to make intuitive dashboards for the information. We will see its execution in our code.

The info text box is presently only a static message box. To get the information, which for this situation is the stock name of an organization, from the UI, we ought to add application callbacks. The read stock name(input_data) is passed as a boundary to the technique update_value. The capability then, at that point, gets every one of the stock information from the Yahoo Money Programming interface from first January 2010 till now, the ongoing day, and is put away in a Pandas information outline. A chart is plotted, with the X-hub being the list of the information outline, which is time in years, the Y-hub with the end stock cost of every day, and the name of the diagram being the stock name(input_data). This diagram is gotten back to the callback covering which then shows it on the UI.

Could it be said that you are enthusiastic about information and hoping to take one monster jump into your vocation?

Our Information Science Course will assist you with changing your game and, in particular, permit understudies, experts, and working grown-ups to hold over into the information science drenching. Ace cutting-edge techniques, incredible assets, and industry best practices, involved undertakings, and certifiable applications. Turn into the leader head of enterprises connected with Information Investigation, AI, and Information Representation with these developing abilities.

Stock cost examination with Python is pivotal for financial backers to grasp the gamble of putting resources into the securities exchange. An organization’s stock costs mirror its assessment and execution, which impacts the interest and supply on the lookout. Specialized examination of the stock is a huge field, and we will give an outline of it in this article. By investigating the stock cost with Python, financial backers can decide when to trade the stock. This article will be a beginning stage for financial backers who need to break down the securities exchange and grasp its unpredictability. In this way, we should plunge into the stock cost examination with Python.

Breaking down market patterns is basic yet trying for merchants and investigators. We can all concur that having a powerful and robotized approach would be priceless.

This extensive aid shows you bit by bit how to use Python for prescient demonstrating and examination of monetary market patterns.

You’ll learn methods like information preprocessing, exploratory examination, measurable demonstrating, AI, and backtesting. Whether you’re a trying quant or hoping to upgrade algorithmic exchanging methodologies, this instructional exercise takes care of you.

Prologue to Market Patterns Examination with Python

Investigating market patterns is critical for going with information-driven speculation choices and creating beneficial algorithmic exchange systems. Python gives a flexible stage to monetary information investigation with its broad libraries like Pandas, Lumpy, and Matplotlib.

Understanding Business Sector Patterns

Market patterns allude to general cost developments in a monetary market throughout some undefined time frame. A few normal kinds of patterns include:

Costs are making new records all around Downtrends Costs are making worse high points and worse low points Sideways patterns Costs are moving inside a reach, with no unmistakable course

Recognizing patterns is vital to check market feeling and go with informed exchanging choices. Measurable procedures can decide whether saw patterns are genuinely huge.

How would you perform a securities exchange examination in Python?

To perform a securities exchange examination in Python, you want to introduce a few key libraries that empower monetary information control and perception.

How would you identify a pattern in Python?

To identify patterns in time series information utilizing Python, there are a couple of key stages:

Import and investigate the information. Use Pandas and information perception libraries like Matplotlib to import the time series dataset, comprehend its construction, and plot the information after some time to examine for any patterns or examples outwardly. Work out clear measurements like mean and change after some time.

Fit a direct relapse model. Utilizing Numpy, Statsmodels, or Scikit-learn, fit a basic direct relapse model with time or a date file as the indicator and the metric you need to dissect as the reaction variable.

Break down the relapse coefficients. The coefficient for the time variable addresses the incline – if positive, it demonstrates a rising pattern over the long run. Test whether the coefficient is genuinely altogether more noteworthy than zero utilizing strategies like p-values and t-tests.

Measure pattern strength. The greatness of the relapse incline shows how quickly the measurement is changing over the long haul. You can annualize the coefficient to evaluate the yearly development rate. The R-squared of the model estimates the amount of the variety that is made sense of by the pattern.

Gauge future qualities. Utilize the fitted model to extrapolate and foresee future qualities. Work out forecast spans to evaluate vulnerability. Screen future information to distinguish changes in patterns.

In synopsis, Python’s information examination libraries like Pandas, Statsmodels, and Scikit-learn give the capacities to demonstrate time series information, evaluate drifts measurably, gauge into the future, and progressively identify pattern changes.

How to do information investigation utilizing Python?

Python is an extraordinary flexible programming language that can be utilize for many information examination assignments. The vital stages to perform exploratory information examination (EDA) in Python.

Information Representation

Use Matplotlib and Seaborn to make smart plots and graphs to additionally investigate the information. These libraries give command over modifying the perceptions.

This covers the critical stages for utilizing Python to set up a dataset and play out an underlying exploratory information investigation. From here you can continue toward further developed examination, demonstrating, and perception methods.