Stock Exchanging for Novices: A Far-reaching Guide

Presentation

Stock trading can be a captivating and perhaps remunerating technique for caring for money and fostering wealth. In any case, it can be overwhelming and scary for novices. This guide intends to demystify the universe of stock trading and give an undeniable, step-by-step method for managing to help you start.

What is a Stock Exchange?

Stock trading incorporates exchanging segments of public partnerships. Right when you purchase a stock, you own a piece of that association. If the association performs well and its stock expense extends, the value of your hypothesis is created. On the other hand, expecting the association to perform insufficiently, the stock expense can fall, provoking potential incidents.

Sorts of Stock Exchanging

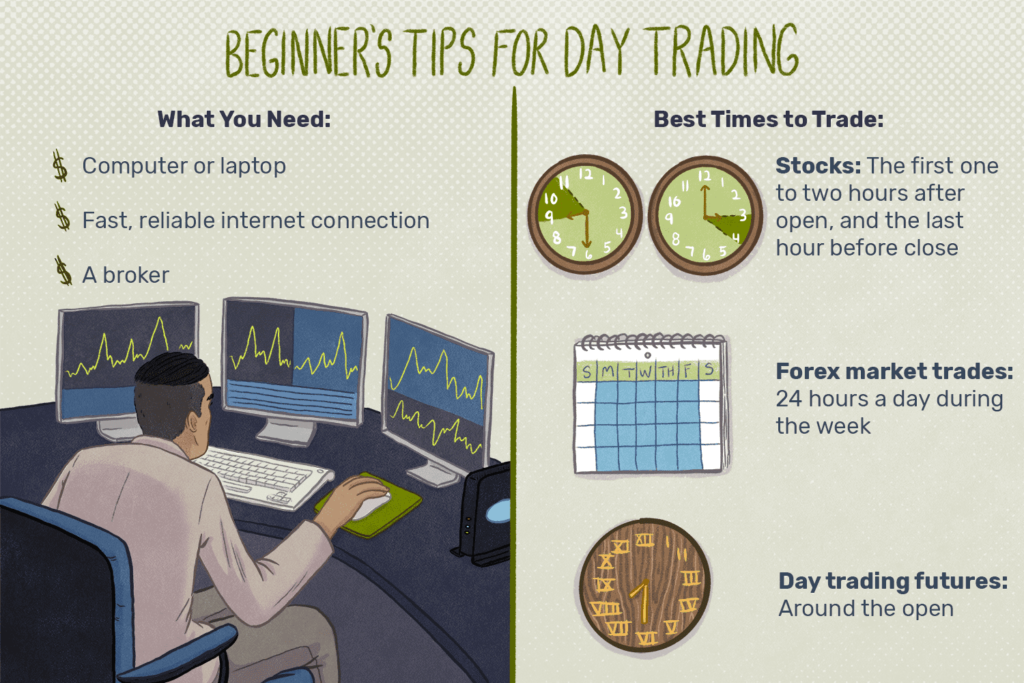

Day Exchanging: This includes trading stocks inside a similar exchanging day. Informal investors intend to gain from momentary market variances. It’s a high-risk, high-reward methodology requiring significant information, experience, and time.

Long haul Money management: This includes purchasing stocks and holding them for a drawn-out period, regularly years. Long-haul financial backers center around the general development capability of the organization and advantage from the force of progressive accrual and market value increase over the long haul.

Getting everything rolling with Stock Exchanging

Instruct Yourself

Before hopping into stock trading, it’s crucial to show yourself the protections trade, trading systems, and the factors influencing stock expenses. Various electronic resources, books, and courses are open to help juveniles with developing serious areas of fortitude for a.

Put forth Monetary Objectives

Decide your monetary objectives and how the stock exchange squeezes into your general speculation methodology. Is it true that you are hoping to produce momentary benefits or create long-haul financial momentum? Understanding your objectives will direct your exchanging choices and hazard resilience.

Pick a Financier

To begin exchanging stocks, you’ll have to open a record with a financier firm. Merchants go about as mediators between you and the securities exchange, working with your trade orders. While picking a financier, consider factors, for example,

Charges and Commissions: Search for a financier with serious expenses. A few representatives offer a sans-commission exchange, while others might charge per exchange.

Pick a stage with an instinctive and simple to-utilize interface, particularly if you’re a fledgling.

Research Apparatuses: Admittance to vigorous exploration devices, graphs, and examination can be useful in pursuing informed exchanging choices.

Client service: Dependable client assistance can be vital, particularly when you experience issues or have questions.

Make an Exchanging Plan

An exchange plan frames your exchange procedure, including your monetary objectives, risk resistance, and explicit standards for entering and leaving exchanges. A distinct exchange plan can assist you with remaining restrained and staying away from close-to-home independent direction.

Begin with a Training Record

Numerous financiers offer practice accounts, otherwise called paper exchanging accounts, where you can exchange with virtual cash. This permits you to figure out the exchanging stage and test your techniques without gambling genuine cash.

Major Investigation versus Specialized Examination

Stock merchants utilize two essential techniques to examine stocks: crucial examination and specialized investigation.

Basic Investigation

The basic investigation includes assessing an organization’s monetary well-being and execution to decide its inherent worth. Key variables to consider include:

Budget summaries: Examine pay proclamations, monetary records, and income explanations to survey an organization’s benefits, obligation levels, and income.

Income Reports: Quarterly and yearly profit reports give bits of knowledge into an organization’s presentation and future possibilities.

Financial Pointers: Macroeconomic elements, for example, loan fees, expansion, and Gross domestic product development, can influence an organization’s presentation and stock cost.

Industry Patterns: Understanding the more extensive industry patterns can assist you in distinguishing organizations with solid development potential.

Specialized Examination

The specialized examination includes dissecting authentic value diagrams and exchanging volume to distinguish examples and patterns. Dealers utilize different devices and markers, for example, moving midpoints, relative strength lists (RSI), and Bollinger Groups, to make expectations about future cost developments.

Building an Enhanced Portfolio

Expansion is a vital guideline in financial planning. By spreading your speculations across various resource classes, areas, and geographic locales, you can lessen hazards and increment the potential for returns. An expanded portfolio might include:

Stocks: Put assets into a mix of gigantic cap, mid-cap, and little cap stocks from various endeavors.

Protections: Protections can turn out a reliable income stream and probably help against monetary trade unsteadiness.

Normal Resources/ETFs: These resources pool cash from various monetary sponsors to buy a widened game plan of stocks, bonds, or various assets.

Land: Land adventures can turn out rental income and probable appreciation.

Things: Placing assets into items like gold, silver, and oil can uphold against development and expand your portfolio.

Risk The Board

Compelling gambling the executives is essential in the stock exchange. A few systems to oversee risk include:

Setting Stop-Misfortune Orders: A stop-misfortune request consequently sells a stock when its value tumbles to a foreordained level, restricting likely misfortunes.

Position Measuring: Decide the fitting size of each exchange in light of your gamble resistance and the general size of your portfolio.

Broadening: As referenced previously, enhancing your portfolio can lessen the effect of a poor-performing venture.

Keeping away from Close home Exchanging: Adhere to your exchanging plan and try not to go with rash choices in light of dread or eagerness.

Remaining Informed

The securities exchange is affected by different variables, including financial information, international occasions, and company-explicit news. Remaining informed about these variables can assist you with pursuing better exchanging choices. Far to remain informed include:

Monetary News: Follow respectable monetary news hotspots for the most recent market updates and investigations.

Monetary Reports: Focus on financial reports and pointers, for example, work information, expansion rates, and national bank declarations.

Organization Declarations: Monitor profit reports, item dispatches, and other organization-explicit news that can influence stock costs.

Market Opinion: Screen financial backer feelings and market patterns through opinion pointers and online entertainment stages.

Normal Errors to Stay Away from

Amateur dealers frequently commit errors that can prompt critical misfortunes. A few normal traps to stay away from include:

Absence of Exploration: Neglecting to direct exhaustive examination before creating an exchange can bring about unfortunate speculation choices.

Overtrading: Exchanging too much of the time can prompt high exchange costs and expanded risk.

Overlooking Gamble The executives: Dismissing risk the board procedures can prompt significant misfortunes.

Pursuing Patterns: Getting on board with that fad of famous stocks without legitimate examination can be unsafe.

Allowing Feelings to Drive Choices: Permitting feelings to direct exchanging choices can bring about rash and nonsensical activities.

Stock exchanging can be a remunerating try whenever draw closer with the right information, procedure, and discipline. By teaching yourself, laying out clear monetary objectives, picking a solid financier, and fostering an obvious exchange plan, you can build your odds of coming out on top. Make sure to utilize both key and specialized investigation, expand your portfolio, oversee risk really, and remain informed about market advancements. Stay away from normal missteps, and persistently refine your exchanging techniques to turn into a more capable and certain dealer. Cheerful exchanging.

Stock trading can be a charming and perhaps remunerating development for juveniles expecting to foster their wealth. It remembers exchanging parts of unreservedly recorded associations for request to make an increase as the stock costs rise or fall. Yet stock trading could give off an impression of being perplexed every step of the way, understanding key thoughts and methods can help new dealers with investigating the market with sureness. In this assistant, we’ll research the stray pieces of stock trading, the mechanical assemblies, and stages used, how to cultivate a trading technique, and the risks and prizes related to stock trading.

What is the Stock Exchanging?

Stock trading implies the exchanging of parts of an association through a stock exchange. Shares address ownership in an association, and when you purchase a stock, you become a financial backer. By having shares, you have a case on a piece of the association’s assets and advantages. In any case, you’re fundamental evenhanded as a stock merchant is to buy stocks for a minimal price and deal them at a more noteworthy expense to secure an advantage.

How Does the Financial Exchange Function?

The monetary trade fills in as a bargaining structure where buyers and vendors get together to trade stocks. Stock exchanges, for instance, the New York Stock Exchange (NYSE) or NASDAQ go about as the fundamental business communities for these trades. A stock’s not completely firmly established by the natural market: on the off chance that more people want to buy a stock (demand) than sell it (supply), the expense goes up, as well as the opposite way around.

Right when you want to trade stocks, you’ll need to open a currency market store, which goes similarly a go-between between you and the stock exchange. Your middle person works with trades by planning your exchange demand with a contrasting merchant or buyer. Thus, handles regularly charge a cost or commission for executing trades.

Opening a Money market fund

The most important phase in the stock exchange is to pick a business and open a record. A money market fund is a web-based stage that permits you to trade stocks. There is a wide range of financier firms, each with its arrangement of elements, charges, and advantages. The two principal sorts of representatives are:

Full-administration facilitates: These organizations offer a large number of administrations, including customized monetary counsel, examination, and an abundance of the board. Full-administration specialists will quite often charge higher expenses yet can be a decent decision for fledglings who need proficient direction.

Markdown merchants: Rebate specialists, like TD Ameritrade, E*TRADE, and Robinhood, offer minimal expense exchange with fewer administrations. These stages are great for independent financial backers who need to autonomously deal with their exchanges.

Ideas Each Fledgling Ought to Be aware

Before jumping into stock exchanging, seeing some fundamental wording and concepts is fundamental:

Stocks and Offers

A stock addresses fractional responsibility for the organization. Each portion of stock is a unit of this proprietorship. Right when you buy an association’s stock, you are purchasing a piece of the association.

Benefits are portions made by an association to its financial backers out of its advantages. Not all associations convey benefits, yet those that truth be told do, generally speaking, make standard portions to remunerate financial backers.

Market Requests versus Limit Requests

A market request is a guidance to trade a stock quickly at the ongoing business sector cost. Market orders are executed rapidly however may not give the most ideal cost.

A breaking point request permits you to set a particular cost at which you need to trade a stock. The exchange will possibly execute if the stock arrives at your predetermined cost, offering more command over your exchanges.

Bid and Ask Costs

The bid cost is the greatest cost a purchaser will pay for a stock, time the ask cost is the least value a vendor will acknowledge. The contrast between the bid and ask cost is known as the spread.

Bull and Bear Markets

A buyer market happens when stock costs are rising, empowering purchasing action, while a bear market happens when costs are falling, prompting negativity and selling.

Fostering a Stock Exchanging Procedure

Progress in the stock exchange relies upon having a thoroughly examined system that lines up with your objectives, risk resistance, and time skyline. Here are a few normal techniques utilized by merchants:

Buy and Hold

This is an excessively long system where monetary supporters buy stocks and hold them for an extended period, betting that the expense will rise over an extended time. This strategy ends up being brutal for individuals who believe in the somewhat long-term improvement ability of the associations they put assets into.

Day Exchanging

Day exchanging includes trading stocks around the same time to exploit transient cost developments. This methodology requires close checking of the market and a solid comprehension of specialized examination. Day exchanging is viewed as a high gamble and isn’t suggested for amateurs.

Swing Exchanging

Swing dealers intend to catch short- to medium-term acquires north of a few days or weeks. They utilize both specialized and basic investigation to recognize patterns and cost developments. Swing exchanging is less extreme than day exchanging yet requires dynamic administration.

Dangers and Awards of Stock Exchanging

Like any venture, the stock exchange accompanies gambles. It’s fundamental to know about these dangers and foster techniques to alleviate them.

Unpredictability Hazard

Stock costs can change decisively over brief periods because of market news, income reports, monetary circumstances, or worldwide occasions. This unpredictability can prompt significant additions or misfortunes.

Liquidity Chance

A few stocks might have low exchange volumes, making it hard to trade them at your ideal cost. This can prompt more extensive spreads and expected misfortunes.

Market Chance

The general market bearing can influence individual stocks. In a bear market, even well-performing organizations might see their stock costs decline.

Notwithstanding these dangers, the stock exchange offers the potential for significant yields. By and large, stocks have outflanked other resource classes like securities or bank accounts over the long haul, making them an appealing speculation for growing a strong financial foundation.

Risk The board for Novices

To oversee risk, amateurs ought to take on the accompanying practices:

Enhancement: Spread your speculations across various areas and resource classes to lessen openness to any single stock or industry.

Begin Little: Start with little ventures to acquire insight and try not to gamble an excessive amount of capital forthright.

Set Stop-Misfortune Orders: A stop-misfortune request consequently sells a stock when it arrives at a foreordained value, assisting with restricting expected misfortunes.

Teach Yourself: Persistently find out about the stock exchange, market patterns, and procedures. Numerous financiers offer instructive assets, online classes, and demo records to work on exchanging without genuine cash.

Close to home Discipline

Close-to-home discipline is a basic part of an effective stock exchange. The financial exchange is affected by feelings like trepidation and ravenousness, and fledgling dealers are frequently enticed to pursue hasty choices. For instance, selling during a market plunge out of dread or purchasing during a meeting out of voracity can prompt misfortunes. Adhering to your exchanging plan and going with choices given rationale as opposed to feeling is critical to long-haul achievement.

Stock exchanging can be a productive undertaking for fledglings who carve out opportunities to get familiar with the rudiments, foster an exchanging procedure, and oversee gambles successfully. Understanding how the financial exchange functions, picking the right financier, and getting to know key ideas are the most vital moves toward turning into an effective dealer. With tolerance, discipline, and constant learning, you can explore the securities exchange and accomplish your monetary objectives. Keep in mind, while the potential for remunerations is high, the stock exchanging likewise implies chances, so moving toward it with alertness and a long haul is fundamental