Technical Analysis Forex

Forex exchanging, or unfamiliar trade exchanging, includes the trading of monetary forms to create a gain. One of the basic apparatuses that merchants use to pursue informed choices in the forex market is specialized examination. Specialized investigation includes assessing authentic value developments and exchanging volumes to gauge future cost developments. This approach depends on different graphs, pointers, and examples to recognize exchanging open doors. In this far-reaching guide, we will investigate the crucial ideas of specialized examination in forex exchanging, including key markers, graph examples, and systems.

The Fundamentals of Specialized Examination

Cost graphs are the underpinning of specialized investigation. They give a visual portrayal of the value developments of money matches throughout various periods. The most widely recognized sorts of cost diagrams utilized in forex exchanging are:

Line Graphs: A straightforward diagram that interfaces shutting costs over a predefined period with a consistent line.

Bar Diagrams: Each bar addresses the open, high, low, and close (OHLC) costs for a particular period.

Candle Outlines: Like bar diagrams however more outwardly engaging, candle graphs use “candles” to address cost developments. Each flame has a body (the reach between the open and close) and wicks (the high and low costs).

Patterns and Trendlines

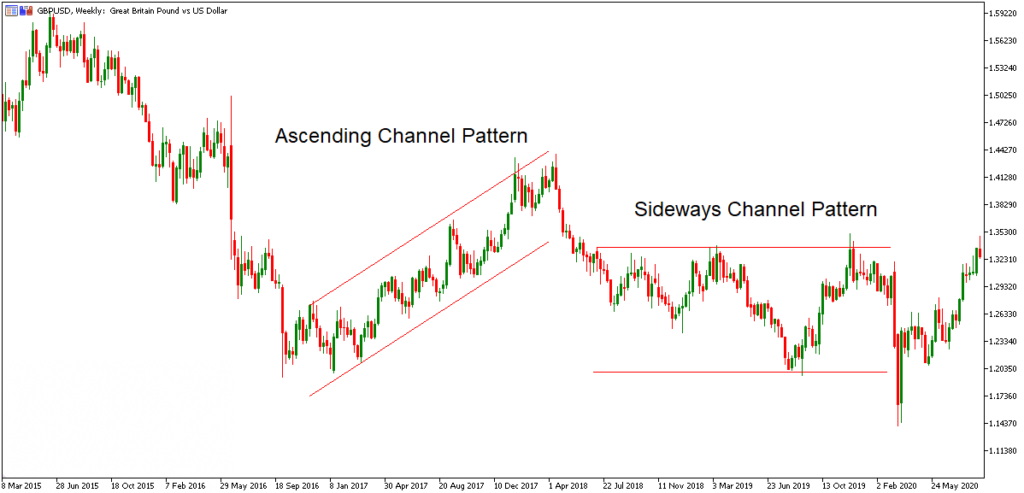

Recognizing patterns is critical in the specialized examination. A pattern is the overall course where the market is moving. There are three sorts of patterns:

Upswing: A progression of new records all around, showing bullish market opinion.

Downtrend: A progression of worse high points and worse low points, demonstrating negative market feeling.

Sideways Pattern: When the market moves inside a reach without an unmistakable heading.

Trendlines are attracted to interface the highs in a downtrend and the lows in an upturn, assisting dealers with recognizing backing and opposition levels.

Specialized Markers

Specialized markers are numerical computations because of verifiable cost and volume information. They assist merchants with recognizing expected passage and leave focuses. Here are a few fundamental specialized pointers utilized in forex exchanging:

Moving Midpoints

Moving midpoints smooth out value information to recognize the bearing of the pattern. There are two fundamental sorts:

Basic Moving Normal (SMA): The typical cost over a predefined number of periods.

Outstanding Moving Normal (EMA): Gives more weight to late costs, making it more receptive to current economic situations.

Relative Strength File (RSI)

The RSI is an energy oscillator that actions the speed and change of cost developments. It goes from 0 to 100 and recognizes overbought or oversold conditions. An RSI over 70 demonstrates overbought conditions, while an RSI under 30 shows oversold conditions.

Moving Normal Union Uniqueness (MACD)

The MACD is a pattern following a force pointer that shows the connection between two moving midpoints (normally the 12-day EMA and the 26-day EMA). It comprises of the MACD line, the sign line, and the histogram. Hybrids between the MACD line and the signing line can flag possible trade amazing open doors.

Bollinger Groups

Bollinger Groups comprise of a center band (SMA) and two external groups that address standard deviations from the center band. They assist dealers with recognizing instability and potential cost inversions. At the point when costs move near the external groups, it might show overbought or oversold conditions.

Outline Examples

Outline designs are developments made by cost developments on a diagram. They assist dealers with anticipating future cost developments given authentic examples. Some normal diagram designs include:

Head and Shoulders

The Head and Shoulders design is an inversion design that flags a shift in pattern course. It comprises of three pinnacles: a higher pinnacle (the head) between two lower tops (the shoulders). An opposite Head and Shoulders design flags a likely inversion from a downtrend to an upswing.

Twofold Tops and Twofold Bottoms

Twofold Tops and Twofold Bottoms are inversion designs that demonstrate potential pattern inversions. A Twofold Excellent conditions after an upturn and signs a negative inversion, while a Twofold Base structures after a downtrend and signals a bullish inversion.

Triangles

Triangles are continuation designs that show the market is uniting before going on toward the predominant pattern. There are three sorts of triangles:

Climbing Triangle: Shaped by an even opposition line and a vertical slanting helpline, demonstrating an expected bullish breakout.

Dropping Triangle: Framed by an even help line and a descending slanting opposition line, demonstrating an expected negative breakout.

Even Triangle: Framed by two uniting trendlines, demonstrating a breakout in one or the other heading.

Specialized Investigation Methodologies

Specialized investigation methodologies include utilizing a blend of pointers, diagram designs, and different instruments to go with exchanging choices. The following are a couple of famous techniques:

Pattern Following

Pattern-following methodologies include recognizing the bearing of the pattern and making exchanges a similar course. Moving midpoints and trendlines are regularly involved apparatuses in this procedure. Brokers might enter an exchange when the cost crosses over a moving normal in an upswing or under a moving normal in a downtrend.

Breakout Exchanging

Breakout exchanging includes distinguishing key help and obstruction levels and entering an exchange when the cost breaks out of these levels. Merchants frequently use outline designs like triangles and square shapes to distinguish expected breakouts. A breakout above opposition might flag a purchasing a potential open door, while a breakout underneath help might flag a selling a valuable open door.

At the point when you are searching for, you check out. These midpoints will let you know if a current pattern is still in play. Be careful: these don’t foresee pattern changes, known as inversions. Brokers for the most part utilize two moving midpoints. Developments above and beneath the 20 and 40-day midpoints are exceptionally famous. 5 and 20-day midpoints are extremely well known for the people who exchange rapidly.

What Is Specialized Examination?

Specialized examination is a strategy for assessing factual patterns in exchanging action, regularly including value development and volume. Recognizing exchanging and speculation opportunities is utilized.

Not at all like principal investigation, which endeavors to assess a security’s worth because of monetary data, for example, deals and profit, specialized examination centers around cost and volume to make determinations about future cost developments.

Grasping Specialized Investigation

Specialized examination is utilized to examine the manners in which the organic market for security influences changes in cost, volume, and suggested unpredictability. It expects that previous exchanging actions and value changes of security can be important marks of the security’s future cost developments when matched with suitable financial planning or exchanging rules.

Specialized examination’s different outlining apparatuses are frequently used to create transient exchanging signals. They can likewise assist with working on the assessment of a security’s solidarity or shortcomings compared with the more extensive market or one of its areas. This data assists investigators with further developing their general valuation gauge.

Oscillator Systems

Oscillator systems include utilizing force markers like RSI and MACD to recognize overbought or oversold conditions. Merchants might enter an exchange when the RSI crosses over 30 (demonstrating oversold conditions) or under 70 (showing overbought conditions). Likewise, MACD hybrids can flag possible trade open doors.

The least demanding method for starting your examination is by learning and applying pattern lines. The main thing you should do is to define a straight boundary that joins two focuses on your graph. To show a pattern line that is expanding, interface two lows in succession, and for a pattern line that is diminishing, interface two straight pinnacles. You will take note that generally, the market (cost) will pull back towards a pattern line before continuing a pattern. At the point when the cost breaks a pattern line, this is the finish of a pattern. The more extended a pattern line is, the more it has been tried and the more significant it is. Note that a pattern line becomes legitimate when the market contacts it multiple times.

Specialized investigation is an incredible asset for forex dealers, empowering them to settle on informed choices given verifiable value information and market designs. By understanding key ideas, for example, cost diagrams, patterns, specialized pointers, and graph designs, brokers can foster successful exchange systems to explore the forex market. While the specialized investigation isn’t secure and implies chances, it gives an organized way to deal with examining market developments and recognizing exchanging valuable open doors. Likewise, with any exchanging procedure, ceaseless learning and practice are crucial for dominating specialized examinations and making long-haul progress in forex exchanging.