The Stock Market is not an Economy

The assertion “The financial exchange isn’t the economy” catches that securities exchange execution and the, generally speaking, monetary wellbeing of a nation are connected yet particular ideas. Here are the central issues to figuring out this qualification—contrasts Between the Financial Exchange and the Economy.

Financial exchange

Addresses public corporations. It mirrors the presentation of these organizations through stock costs and market files.

Economy

It encompasses all monetary exercises inside a nation, including those not public, such as independent ventures, taxpayer-supported organizations, and non-benefit associations.

Markers Financial exchange

Estimated by records like the S&P 500, NASDAQ, and Dow Jones. These records are impacted by financial backer feelings, corporate income, and market hypothesis.

Economy

Estimated by markers like Gross domestic product, joblessness rates, expansion rates, and customer spending. These reflect more extensive financial circumstances and the general soundness of the monetary framework.

Impact Variables Financial exchange

Impacted by variables, for example, loan costs, corporate benefits, financial backer assumptions, and worldwide market patterns. Market opinion can cause instability that isn’t guaranteed to reflect hidden financial circumstances.

The economy is Impacted by financial and money-related approaches, work levels, customer certainty, and worldwide monetary circumstances. Financial not set in stone by efficiency, workforce support, and the equilibrium of exchange.

Securities exchanges, so, frequently appear to have no clear connection to what Americans are going through, monetarily, strategically, and actually.

At present, the securities exchange is being floated by the conviction that the upheld by the approaching organization, will keep on siphoning cash into the business sectors,” College of Warwick market analyst Roger Rancher told Writer’s Asset by email on Jan. 8.

Economy During the Covid Downturn

Different information shows the securities exchange has not mirrored the more extensive economy during the Covid downturn. The S&P 500 and Dow Jones both arrived at record highs toward the finish of 2020, thundering back from steep misfortunes in Spring welcomed on by pandemic-related financial closures.

The bounce back corresponded with the Central Bank’s Walk 23 declaration that it would purchase corporate obligation and different sorts of protections something the U.S. national bank never did during the Incomparable Downturn and its April 9 declaration that it would build those buys, as per “While Selling Becomes Viral Disturbances Under water Markets in the Coronavirus Emergency and the Federal Reserve’s Reaction,” a Public Department of Financial Exploration working paper distributed in May 2020. Justifications for Why the Financial Exchange isn’t the Economy.

Financial backer’s Way of behaving

Securities exchange developments can be driven by financial backer hypothesis and opinion, which can in some cases be separated from the real exhibition of the economy. For example, stock costs might ascend because of confidence or fall because of dread, paying little heed to financial basics.

Corporate Execution versus Monetary Well-being

The financial exchange frequently centers around the exhibition of huge organizations, which can be impacted by factors like mechanical headways, consolidations, and acquisitions. Nonetheless, the general economy incorporates private ventures and areas that probably won’t be addressed in the financial exchange records.

Money-related Approach Effect

National bank strategies, like low-loan costs, can expand stock costs by making getting less expensive, prompting expanded interest in stocks. This can make a financial exchange blast regardless of whether the more extensive economy is battling.

Monetary Conveyance

Abundance created in the securities exchange will in general be concentrated among financial backers, especially those with critical monetary assets. This can prompt a distinction between financial exchange gains and the monetary prosperity of everyone.

Instances of Disparities

Unimaginable Slump (2008-2009) The protections trade crashed, reflecting financial turmoil. Regardless, the recovery of the protection trade was a ton faster than the recovery of the overall economy, which experienced postponed high joblessness and slow GDP improvement.

Covid Pandemic (2020)

No matter what a serious monetary downturn with high joblessness rates and business terminations, the protection trade returned quickly due to wonderful cash-related and financial redesign measures, reflecting positive reasoning for a speedy recovery rather than the brief money-related conditions.

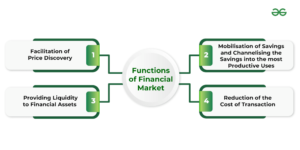

Is the financial exchange connected with financial aspects?

The ascent and fall in stock costs will more often than not impact various monetary elements, including utilization and business venture. Besides, similarly to what the financial exchange means for the economy, a few circumstances likewise influence the securities exchange.

The Securities Exchange

While the securities exchange can give experiences into the well-being of enormous enterprises and financial backer opinions, it’s anything but an exhaustive proportion of the economy. The more extensive economy incorporates different elements and exercises that are not caught by financial exchange files. Understanding both the securities exchange and monetary pointers is critical for an all-encompassing perspective on financial well-being.

The Financial Exchange Represent

because organizations that make up the financial exchange represent trillions of venture dollars, utilize a huge number of individuals, and collect a lot of titles, it’s not difficult to accept that the securities exchange and the economy are something similar.

At the point when the financial exchange is up, you might derive the economy is improving. Essentially, when the securities exchange is down, you might surmise that the general economy is doing more awful.

How are the securities exchange and economy unique?

While the two are interrelated, they have key contrasts. Note that monetary measures connect with the past and can lead up near the present. In the meantime, the securities exchange is believed to be forward-looking, meaning a few financial backers accept it can expect monetary circumstances that might happen from now on.

Size. While the US economy’s size is more than $21T, the securities exchange is at present worth roughly $40T, so almost 2x greater. In any case, the financial exchange’s worth can vacillate altogether. In a slump, the financial exchange’s worth can join generally to the size of the general economy. Noted financial backer Warren Buffett utilizes a proportion of market cap to Gross domestic product, called the “Buffett marker,” to evaluate whether a market is finished or underestimated.

How They Are Estimated?

The two elements have a place with totally various classes. The financial exchange is estimated at a particular *point* in time. The other the economy is estimated during a specific *interval* of time. For instance, from January 1 to December 31st of the year 2021. This qualification is generally alluded to as the differentiation between a stock (in no way related to the values that contain a financial exchange) and a stream.

Development versus Returns

It’s additionally essential to recall that Gross domestic product development doesn’t be guaranteed to compare to positive financial exchange returns. While the two can go together directionally, there are cases when the two have wandered. In certain years, the securities exchange has gone up when Gross domestic product development was negative, while in different years, the securities exchange has gone down while Gross domestic product development was positive.

Truth be told, there might be little connection between Gross domestic product development and securities exchange returns.

Consider a situation where the S&P 500 organizations gain a piece of the pie from the more modest organizations that are not in the record. In that situation, the S&P 500 organizations could perform better compared to the general economy.

All the more critically, as verified over, the economy and the securities exchange, now and again, can decouple. While the economy is doing ineffectively, in a downturn, for instance, financial exchanges can at times bounce back.

How is this possible?

It means quite a bit to get a handle on that the financial exchange is forward-looking. From the perspective of certain financial backers, the securities exchange fills in as a proactive factor for the economy.

That implies the securities exchange *anticipates* further developing circumstances, at times a very long time in front of when conditions begin getting to the next level.

Why confounding the two is significant not

Since the organizations in the S&P 500 (or any financial exchange record) are important for a subset of the general economy, patterns for that subset might separate from the remainder of the economy.

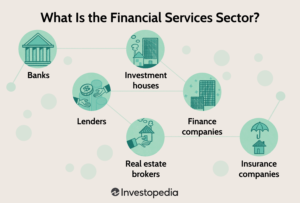

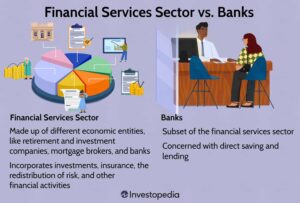

The Financial Exchange Isn’t the Economy

The connection between the financial exchange and the more extensive economy is frequently misconstrued. While the securities exchange earns a lot of consideration from the media, lawmakers, and individual financial backers, it isn’t inseparable from the economy. The securities exchange addresses the worth of offers in public corporations, while the economy envelops the all-out creation of labor and products, work levels, wages, and utilization, and that’s only the tip of the iceberg. While there are points of cross-over, these are two unmistakable elements. Understanding the reason why the securities exchange isn’t equivalent to the economy requires taking a gander at a few key contrasts, including the extent of every, who partakes in each, and what variables impact their vacillations.

The Financial Exchange

The financial exchange is a commercial center where financial backers trade partakes in public corporations. These organizations address just a piece of the whole economy, normally the bigger and more settled organizations. Significant records like the S&P 500, Dow Jones Modern Normal, and NASDAQ Composite track a determination of these public corporations and give a harsh sign of market opinion. At the point when these lists rise, individuals frequently accept that the economy is getting along admirably, and when they fall, they stress that the economy is in a tough situation.

In any case, the financial exchange estimates financial backers feeling about a little cut of the economy. Enormous organizations recorded on stock trades normally overwhelm their enterprises, yet they don’t address the total monetary movement. Areas like private companies, horticulture, and the underground economy, for instance, are not reflected in the securities exchange. Besides, numerous organizations in areas like medical care, schooling, and non-benefits work outside the securities exchange, adding to the economy yet not to stock records.

Another significant qualification is that stock costs change in light of financial backer assumptions regarding future profit, which can be detached from current monetary real factors. Stocks can revitalize during seasons of high joblessness or downturn, reflecting financial backer idealism that organizations will recuperate, or they can plunge during times of monetary development assuming financial backers are worried about future difficulties.

The Economy: What It Addresses

Rather than the securities exchange, the economy is a lot more extensive idea. It envelops the all-out worth of all labor and products delivered inside a nation (GDP or Gross domestic product), as well as measurements that can imagine joblessness, wage development, efficiency, expansion, and buyer spending. These pointers mirror the real monetary circumstances experienced by the vast majority and organizations.

The economy incorporates all areas, in addition to the public corporations that rule the securities exchange. It likewise represents more modest organizations, which make up a huge part of work and contribute considerably to Gross domestic product. Little and medium-sized endeavors (SMEs) are frequently alluded to as the “spine” of numerous economies, yet they are generally missing from securities exchange files since they are exclusive.

Financial backers versus Laborers and Customers

The financial exchange and the economy additionally vary as far as who partakes in each. The financial exchange is essentially determined by institutional financial backers like benefits. Reserves, common assets, mutual funds, and individual rich financial backers. These members center around expanding returns, frequently going with choices because of the momentary. Profit reports, loan fee changes, or worldwide occasions. While a few working-class people put resources into stocks. Through retirement records or individual portfolios, a critical part of stock possession stays concentrated among the well-off.

Conversely, everybody takes part in the economy. Laborers produce labor and products, purchasers get them, and state-run administrations and organizations put resources into framework, advancement, and improvement. Financial approaches, like financial boosts, money-related strategies, and economic accords, straightforwardly influence the economy in manners that go past securities exchange execution. These strategies impact things like work rates, pay levels, expansion, and monetary development, which straightforwardly affect individuals’ lives.

Disengage Between the Securities Exchange and Monetary Reality

One of the most clear instances of the distinction between the securities. Exchanges and the economy happened during the Coronavirus pandemic. In 2020, the U.S. securities exchange bounced back quickly after an underlying accident. Notwithstanding record joblessness, inescapable business terminations, and a serious financial slump. Significant records like the NASDAQ and S&P 500 arrived at all-time highs. Even a large number of individuals were jobless and whole enterprises, like travel and neighborliness, were crushed.

This uniqueness featured the way that the securities exchange. Exhibition doesn’t be guaranteed to reflect monetary reality for the vast majority. The organizations driving securities exchange gains during that period were generally. In areas like innovation, which were better situated to flourish during the pandemic. In the meantime, private companies, lower-wage laborers, and those in hard-hit. Ventures were abandoned, delineating the securities exchange’s restricted extension in addressing the whole economy.