Trade Like a Stock Market Wizard

Exchange Like a Financial Exchange Wizard” is a book by Imprint Minervini, who is an eminent stock merchant with an effective history. His exchanging techniques are nitty gritty in the book, which frames his strategies for accomplishing critical returns in the securities exchange. The following are a few vital standards and systems from the book:

Standards and Procedures

Explicit Section Point: Distinguish definite passage focusing on stocks with high potential.

Risk The board: Use stop-misfortune orders and position measuring to control risk.

Mental Discipline: Remain trained and keep away from close to home exchanges.

Pattern Examination

Search for stock areas of strength for in and enter at exact focuses to augment benefit potential. Utilize specialized examination to recognize patterns and potential breakout focuses.

Profit and Deals Development:

Center around organizations with solid profit and deals development. Minervini searches for stocks with somewhere around 20-25% development there. Dissect quarterly and yearly profit reports for reliable execution.

Relative Strength

Put resources into stocks areas of strength for with strength contrasted with the general market. This shows that the stock is performing better compared to most of the different stocks.

Graph Examples

Distinguish and exchange explicit diagram designs, like cup-with-handle, level base, and other continuation designs. Examples ought to show a union stage followed by an expected breakout.

Market Timing

Use market timing to enter and leave exchanges. Search for signals that demonstrate areas of strength for a climate or possible slump. Remain in a state of harmony with the general market pattern to expand the likelihood of effective exchanges.

Investigation

Consolidate specialized investigation with basic examination to choose high-likely stocks. Examine the organization’s monetary well-being, serious position, and industry patterns.

Volume Examination Focus on exchanging volume, which can affirm the strength of a pattern or sign possible inversions. A high volume of breakouts or critical value developments is a positive marker.

Risk-Prize Proportion

Assess the gamble reward proportion of each exchange. Hold back nothing the potential prize is no less than multiple times the expected gamble. Set stop-misfortune orders to restrict misfortunes and use the following stops to safeguard benefits.

Constant Learning

Remain informed and constantly further develop exchanging abilities. Understand books, follow market news, and gain from both effective and fruitless exchanges.

Screen for High-Development Stocks

Utilize stock screeners to track down stock areas of strength for development, high relative strength, and positive graph designs.

Dissect Diagrams

Concentrate on diagrams to recognize potential passage focuses and guarantee that the stock is in a great pattern.

Set Section and Leave Focuses

Decide explicit passage and leave focuses because of specialized markers and chance administration standards.

Screen Exchanges

Monitor all exchanges and routinely survey execution. Change techniques in light of what is working and what isn’t.

Keep an Exchanging Diary

Record each exchange, including the reasoning, passage, and leave focuses and results. This aids in examining and gaining from past exchanges.

By following these standards and techniques, merchants can foster a restrained way of dealing with the stock exchange which means expanding returns while overseeing risk successfully.

Saving an exchanging diary is a basic practice for any merchant hoping to work on their presentation and make long-haul progress. A very much kept up with exchanging diary assists you with following your exchanges, breaking down your systems, and gaining from both your victories and slip-ups. This is the way to set up and keep a successful exchange diary.

Exchange Like a Securities Exchange Wizard by Imprint Minervini is a thorough aide for brokers who need to prevail in the securities exchange.

It frames Imprint’s exchanging methodology utilizing specialized examination and gives an understanding of his mentality and chance administration procedures.

Center around income.

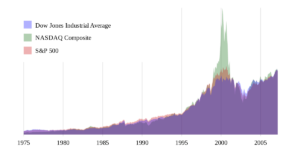

You’ve presumably experienced the expression, “purchase low, sell high.” Assuming this is the case, you might have felt that 2009 was an amazing opportunity to gobble up shares in then-blue-chip organizations like Citigroup, Lehman Siblings, General Engines, and American Global Gathering (AIG) as their costs plunged to notable lows.

However, at that point, it might have likewise been an indication that the worth of those organizations was dropping. The monetary emergency saw AIG crash from $103 to 33 pennies in the range of two years; it was struck from the Dow Jones Modern Record in September 2008, as was Citigroup in 2009. The cost of GM sank 95% in 2009, as well – a misfortune that took it back to its 1933 worth and justified its disposal from the Dow Jones Modern List.

Significant illustration to be learned here:

the securities exchange couldn’t care less about family, just history. The estimation in the commercial center is development. Try not to allow yourself to be convinced into putting resources into a sinking stock basically in light of its name acknowledgment or notoriety. By and large, such stocks have a place with the past; the future might have a place with organizations with names you won’t ever experience.

Such floods of consideration and imminent achievement might prompt a deluge of institutional interest in the stock before the genuine numbers even emerge. This can be a fruitful profit-supporting methodology. Furthermore, assuming the hypothesis is very much established, that presumably implies the numbers will continue onward up the following quarter, as well.

This could seem like a clear exhortation. Yet, in the following area, we’ll see the reason why it’s surprisingly unreasonable.

Exchange Like a Financial Exchange Wizard by Imprint Minervini reveals the methodologies the creator tweaked following quite a while of free learning and experience exchanging stocks. Regardless of early battles and doubters, Minervini distills his hard-won examples into an extensive methodology for recognizing remarkable stock entertainers and creating a trained outlook to oversee risk and secure benefits.

The synopsis digs into Minervini’s framework for spotting high-potential stocks serious areas of strength for showing and specialized markers, and layouts strategies for exactly timing sections and exits. All through, Minervini accentuates center standards like restricting misfortunes to safeguard capital, zeroing in speculations on the most encouraging open doors, and creating strength to explore market unpredictability.

Having been in the speculation market for quite some time and having perused numerous venture books, I wind up ceaselessly cheering “Exchange Like a Financial Exchange Wizard” created by Imprint Minervini, the boss of the American Venture Contest. This book offers a broad investigation of exchanging brain science, contributing methods, and basics. Experiencing such a far-reaching and sweeping book regarding these matters in the market is uncommon

Explicit Section Point Examination (SEPA)

The creator has fostered a framework zeroed in on the normal qualities of super-development stocks, drawing from a huge measure of verifiable information. This framework groups the characteristics and traits showed by past excellent development stocks, named Explicit Section Point Examination or SEPA.

This technique unequivocally characterizes the principles for passage and exit, incorporating five significant components:

Pattern Major areas of strength for stocks

Pattern Major areas of strength for stocks are quite often in an unmistakable vertical pattern during their forceful development stages. The creator accepts that distinguishing the pattern is critical and it incorporates two stages: deciding the stock is in which period of the ascent, and whether the stock value adjusts to a pattern design.

Fundamental The main thrust behind the ascent of solid development stocks for the most part comes from upgrades and development in the organization’s essentials, like income, incomes, and net benefit. A large portion of these enhancements happens before the hazardous development in the stock cost.

Extraordinary Occasions

Stock costs need Exceptional Occasions that invigorate financial backers. Stocks that experience critical assembly generally have basic stories and occasions driving them. Such Exceptional Occasions could draw in revenue from institutional financial backers.

Section Point

serious areas of strength for most stocks will have no less than one generally safe, high-reward passage opportunity, so it’s essential to jump all over the ideal time to enter.

Leave Point

Even stocks that display attributes serious areas of strength for of stocks could not necessarily create as financial backers expect. The central standard is to safeguard exchanging capital; positions should have a set stop-misfortune to cut misfortunes when things go south definitively. Simultaneously, we want to figure out how to perceive when super-development stocks give indications of finishing their run. For fruitful exchanges, at last, we want to offer the stock to acknowledge benefits.

Various Periods of Stock Cost and Pattern Example

To accomplish superior execution, do we have to purchase at the most reduced stock cost? The creator accepts that speculating the lower part of a stock cost is an exercise in futility! What we ought to hold back nothing purchasing stocks at their least or least expensive cost, yet rather getting them at the “right” cost. The “right” value alludes to the cost of the stock not long before it’s going to altogether flood.

Exchange Like a Financial Exchange Wizard” by Imprint Minervini is a strong aide for yearning brokers, offering bits of knowledge given many years of genuine experience. Minervini is a top dog dealer who fostered his strategy through long stretches of study and work, refining it into an efficient methodology that can be applied by anybody with the discipline to follow it. The book’s center is its emphasis on understanding business sector elements and stock way of behaving while at the same time integrating fundamental components like gambling the executives, mental versatility, and specialized examination.

Risk The Executives: The Way to Endurance

Risk the executives is one more significant topic of the book. Minervini clarifies that regardless of how great a merchant’s investigation is, there will constantly be exchanges that conflict with them. The way to long haul outcome in exchanging isn’t in keeping away from misfortunes out and out but in overseeing them when they do happen. This implies utilizing stop misfortunes to restrict the drawback on each exchange. Minervini advocates setting stop misfortunes somewhat close, frequently something like 7% to 10% beneath the section cost. Along these lines, regardless of whether an exchange is resolved, the misfortune will be sensible.

One more part of the hazard the board that Minervini accentuates is position measuring. Merchants ought to never wager a lot on any one exchange. By restricting the size of each position, a dealer can guarantee that even a series of misfortunes will not be devastating. This approach permits merchants to endure the inescapable difficult times that accompany exchanging and guarantees they have the funding to exploit winning exchanges when they go along.

The Significance of Timing and Tolerance

One of the key illustrations Minervini instructs is that timing is everything in the financial exchange. A stock can have extraordinary basics despite everything going no place for a long time or even years on the off chance that it isn’t in the right period of its cost cycle. Minervini’s technique underscores the significance of purchasing stocks just when they are in the right specialized arrangement, which normally implies they are breaking out of a distinct combination design on high volume.

Understanding Business Sector Cycles

Minervini additionally stresses the significance of grasping the more extensive market climate. The securities exchange moves in cycles, shifting back and forth between times of development and constriction. Knowing where the market is in its cycle can assist merchants with deciding when to be forceful and when to be cautious. During buyer markets, merchants ought to be hoping for areas of strength to exploit and clutch their triumphant situations as far as might be feasible. In any case, during bear markets or times of rectification, it’s critical to diminish openness and spotlight protecting capital.

As well as understanding the general market cycle, Minervini stresses the significance of watching out for area strength. Stock areas of strength for it will generally beat the more extensive market, and dealers can frequently expand their chances of accomplishment by zeroing in on stocks in driving areas. By conforming to the most grounded stocks in the most grounded areas, dealers can place the chances in support of themselves.

The Force of Compounding

One of the key standards Minervini features in his book is the force of compounding. He shows how even moderately humble returns, when intensified over the long run, can prompt significant increases. For instance, on the off chance that a merchant can average a 20% return each year, they will twofold their cash generally every 3.5 years. Throughout 10 years, that can transform an unassuming measure of capital into a critical total.

However, to exploit the force of compounding, dealers should stay away from huge misfortunes. As Minervini brings, a half up, a dealer of their capital on a solitary exchange needs to make a 100 percent get simply to get once again to even. For this reason risk the board is so significant and why Minervini stresses the significance of keeping misfortunes little and safeguarding capital no matter what.

Exchanging Brain research

Notwithstanding the specialized and key parts of exchanging, Minervini likewise addresses the significance of exchanging brain science. Exchanging is an intellectually requesting action, and dealers should figure out how to get a grip on their feelings in the event that they will prevail in the long haul. Dread and avarice are the two greatest inner difficulties that merchants face, and Minervini gives systems to defeating them.

One of the key mental standards Minervini stresses is the requirement for discipline. Brokers should adhere to their arrangement and try not to pursue close to home choices. This implies adhering to their gamble the board guidelines, in any event, when it’s awkward, and not letting momentary market developments shake them out of their positions rashly.

Another significant mental idea Minervini talks about is the requirement for self-assurance. Fruitful merchants should have confidence in their capacity to use sound judgment and stick with their procedure, in any event, when things aren’t working out in a good way. This requires a specific degree of close to home strength and the capacity to remain fixed on the higher perspective as opposed to becoming involved with transient market clamor.

Constant Learning and Variation

At last, Minervini stresses the significance of consistent learning. The financial exchange is continuously changing, and dealers should adjust assuming they will prevail over the long haul. This implies concentrating available consistently, staying aware of new turns of events, and being willing to change their procedure when vital.

Minervini himself went through years fostering his system, and he urges dealers to adopt a comparable strategy. There is no “one-size-fits-all” way to deal with exchanging, and what works for one individual may not work for another. The key is to track down a framework that accommodates your own character and hazard resistance and to continue to refine it over the long haul as you gain insight.