Trading News Forex

During the 1400s, the idea of forex exchanging was very not quite the same as what we know today. During this time, the essential method for unfamiliar trade and exchanging news rotated around the exercises of vendors, investors, and dealers across various European urban areas. This is a preview of the way unfamiliar trade and exchanging news worked during the 1400s:

The Scene of Forex Exchanging the 1400s

Development of Banking Families: Noticeable financial families, like the Medicis of Florence and the Fuggers of Augsburg, were instrumental in molding the early unfamiliar trade market. They gave the framework important to trading monetary forms, loaning, and working with exchange across various areas.

Cash Transformers: Cash transformers were among the earliest forex brokers. They worked in commercial centers and significant exchange centers, changing monetary standards for shippers and voyagers. They assumed a vital part in working with exchange by giving a way to trade one money for another.

Utilization of Bills of Trade: Bills of trade were generally utilized as a type of credit and installment strategy. Vendors and brokers gave these bills, permitting dealers to settle exchanges without expecting to convey huge amounts of money. This framework empowered more direct worldwide exchange and gave an instrument to cash trade.

Goldsmith-Financiers: Goldsmiths who additionally filled in as brokers were vital to the forex exchange in London. They held stores and gave receipts, which in the end advanced into banknotes. They likewise gave credit offices, permitting brokers to fund their endeavors and convert various monetary forms.

Exchanging News the 1400s

Vendor Organizations: Shippers depended intensely on data from their organizations for exchanging news. They conveyed through letters and couriers, sharing insights regarding economic situations, costs, and valuable open doors.

Exchange Fairs: Significant exchange fairs, similar to those in Bruges, Venice, and Champagne, were key scenes for get-together news and leading business. These fairs permitted traders to meet, trade merchandise, and talk about market patterns and conditions.

The job of Dispatches: Messengers assumed an essential part in spreading and exchanging news. They went among urban areas and locales, conveying letters and data about market improvements and money values.

Legislative Impact: Political occasions and choices by administering specialists essentially affected exchanging conditions. News about wars, unions, and exchange guidelines frequently went through political channels and impacted cash values and exchange approaches.

Inheritance

The practices and organizations laid out during the 1400s laid the foundation for current forex exchanging and monetary business sectors. The strategies for correspondence, the utilization of credit instruments like bills of trade, and the jobs of shippers and brokers in working with cash trade have all developed yet keep on supporting the worldwide monetary framework. The present forex market, driven by innovation and worldwide availability, owes a lot to these early practices in exchange and trade.

One of the extraordinary benefits of exchanging monetary forms is that the forex market is open 24 hours every day, five days per week. Since business sectors move given information, monetary information is much of the time the main impetus for transient developments. This is especially evident in the cash market, which answers not exclusively to U.S. monetary numbers yet in addition to news from around the world. Here, we take a gander at which financial numbers are delivered when, which information is generally pertinent to forex merchants, and how dealers can follow up on this market-moving data.

Tradable monetary standards

Length the globe, and you can handpick the monetary standards and financial deliveries you need to give specific consideration to. By and large, since the U.S. dollar is on the “opposite side” of 88% of all cash exchanges, U.S. financial deliveries will more often than not greatest affect forex markets.

Bank for Global Settlements. “Third National Bank Study.”

Exchanging news discharges is difficult. Some news discharges are a higher priority than others. For example, for merchants who take part in the famous act of exchanging around organization profit discharges, in addition to the fact that the announced agreement figure is significant, so are the murmur numbers (the informal and unpublished conjectures) and any corrections to earlier reports. Exchanging worldwide news occasions is one more generally followed type of exchanging; the monetary effect on unfamiliar and homegrown business sectors can change significantly contingent upon the nation giving the data.

When Are Key News Deliveries?

The table beneath records the estimated times (in the Eastern Season) of the main monetary. Deliveries for every one of the accompanying nations. These are likewise the times when dealers give additional consideration to the business sectors on the off chance that exchanging in light of information discharges.

How Long Does News Influence the Market?

As indicated by a concentrate by Martin D. D. Evans and Richard K. Lyons distributed in the Diary of Global Cash and Money in 2005, the market may as yet be engrossing or responding to news discharges hours, if not days after the numbers are delivered.

The investigation discovered that the impact on returns, by and large, happens on the first or second day, yet the effect appears to wait until the fourth day. The effect on the progression of trade orders, then again, is still exceptionally articulated on the third day and is noticeable on the fourth day.

Top five forex news or events:

- Central banks rates

- GDP

- CPI

- Employment Indicators

- FOMC Meeting

Interest rates

The cost of borrowing money. The return you get for putting your money into saving account.

-

Central Banks Rates:

Each month the world’s various Central Banks meet to decide over the interest rates they are responsible for. They face the decision of whether to leave rates unchanged, raise rates, or lower rates. The outcome of this decision is extremely important to the currency of the economy and such, to traders.

-

GDP:

When GDP falls below market expectations, currency values tend to fall and when GDP outdoes expectations, currency values tend to rise. Thus this figure’s release is closely followed by currency traders and can be used to cautiously anticipate Central bank movements. In simple terms, it measures the size of country’s economy.

-

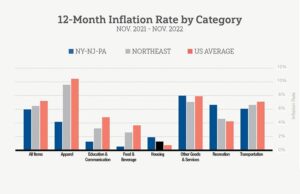

CPI:

The consumer price index is the most widely used inflation measure out of the various economic indicators. The index gives information about the historical average prices paid by consumers for a basket of market goods and highlights whether the same goods are costing more or less for consumers. It refers to the rate at which the level of prices of goods and services is rising and purchasing power is falling.

Central Banks monitor this release to help guide them in their rate and policy setting. If inflation is seen to be evident, and moving beyond a certain target then interest rate rises are used to counter this.

-

Employment indicators:

The employment rate of a country is crucial to markets and is very important to central banks as an indicator of the health of the economy. Higher employment leads to interest rate rises as Central banks aim to balance inflation with growth and as such this figure draws huge market attention from traders. NFP is an important employment report for the U.S.

Alongside the unemployment rate, the most important labor statistics are the US NFP figures released each month with the NFP taking prime position.

-

FOMC meeting:

Although the Central Bank meetings of all economies are extremely important, the US’s Federal Open Market Committee meeting takes center stage as the US dollar is currently the world’s reserve currency.

Each month the committee meets to set rates and to give its pronouncement current economic conditions. The effectiveness of current monetary policy, inviting forecasts for expectations of future economic conditions and monetary policy.

The committee is made up of members which vote at each meeting, with “Hawkish” members being those in favour of a rate rise and “Dovish” members those favoring a lowering of rates.

Some top sources for Forex Trading:

- Reuters> comprehensive coverage of global financial markets, including Forex.

- Bloomberg> real-time news, analysis, and market data for Forex traders.

- Forex Factory> Forex news, analysis, and market commentary.

- FX Street> forex news, analysis, and market insights.

- Daily-FX> forex news, analysis, and market commentary.

- Link unavailable> real-time forex news, analysis, and market data.

- FX Empire> forex news, analysis, and market insights.

- The Forex Market> Forex news, analysis, and market commentary.

- Forex Crunch> Forex news, analysis, and market insights.

- Baby pips> forex news, analysis, and market commentary, with a focus on beginner traders.

These resources provide up-to-date news, analysis, and market insights to help Forex traders make informed decisions.

Instructions to Really Exchange News

One familiar method for exchanging news is to search for a time of solidification in front of a significant information discharge and to exchange the breakout response to the news. This might be finished on an intraday premise or in more than a few days.

How did forex trading become successful?

There are some tips shown:

- Education and knowledge:

Knowledge about Forex Markets, trading rules, and risk management.

- Develop a trading plan:

Set clear goals, risk tolerance, and entry-exit rules.

- Choose a reliable broker:

Select a reputable and regulated Forex broker.

- Start with demo account:

Learn trading with effective funds before triggering real money.

- Risk management:

Use proper position sizing, stop-loss orders, and leverage.

- Stay disciplined and patient:

Keep away from automatic decisions and pay attention to your trading plan.

- Continuous learning:

Stay updated on market analysis, news, and trading strategies.

- Diversification:

Trade multiple currency pairs and asset classes.

- Psychological controls:

Manage emotions, greed, and fear to make rational trading decisions.

We learn about forex news trading in the correction territory business. It is helpful for everyone who wants to gain knowledge for trading.