What is the S&P 500 and how is it calculated

One of the worth records that are generally broadly watched, it is some of the time viewed as a benchmark for the U.S. protection trade.The organizations remembered for the S&P 500 are chosen by the File Board of Trustees at Standard and Poor’s, in light of different rules like market capitalization, liquidity, area portrayal, and monetary feasibility. The file addresses the variety of the U.S. economy and is frequently utilized by financial backers and experts to check the well-being and bearing of the securities exchange.

The computation of the S&P 500 list depends on the available capitalization of its constituent organizations. Market capitalization is determined by increasing the ongoing stock cost of an organization by the number of exceptional offers. The file is weight by market capitalization, implying that organizations with bigger market capitalizations greatly affect the list’s worth.

Stock Part

The rundown divisor is a reliable one that is switch as per keep around with movement in the record regard for a long time, particularly when there are corporate exercises like stock parts, benefits, or solidifications that could impact the document’s worth.

For the most part, the S&P 500 provides monetary supporters with a portrayal of the introduction of the greatest public enterprises in the U.S. Besides, is a key instrument for following the overall sufficiency of the U.S. protection trade.

How to compute S&P 500 profit?

Profit Yield mirrors the amount of the fundamental S&P 500 organizations’ income for the earlier year, separated record levels toward the year’s end.

The S&P 500 is a financial exchange file that tracks the presentation of 500 huge-cap U.S. organizations recorded on stock trades like the New York Stock Trade (NYSE) and the Nasdaq. It’s viewed as a benchmark for the U.S. securities exchange and a measure of general monetary well-being.

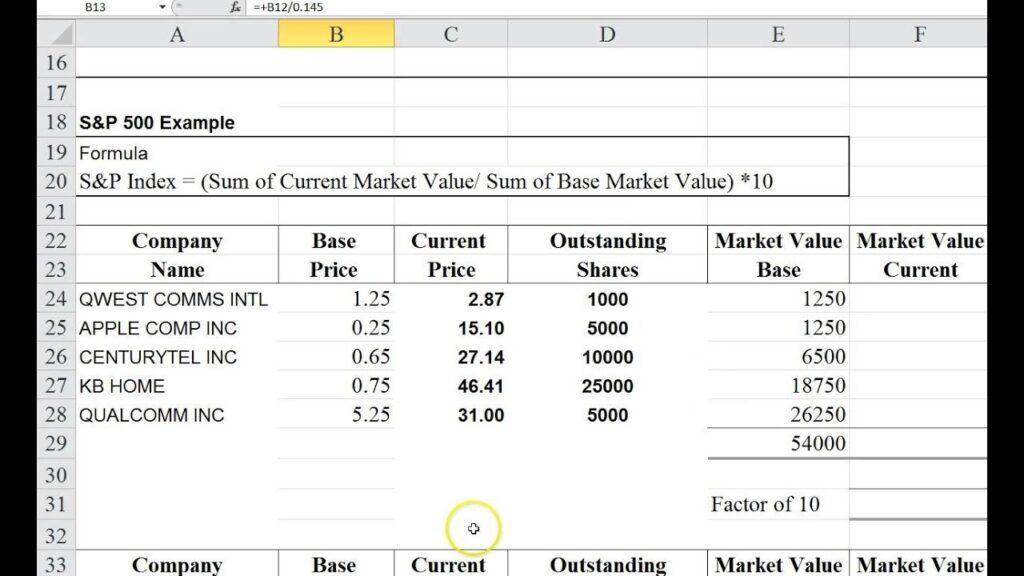

This is the way the S&P 500 is determined

Each organization’s effect on the file esteem depends on its market capitalization (market cap). Market cap is an organization’s stock cost duplicate by the complete number of exceptional offers. Organizations with bigger market covers affect the S&P 500’s worth contrasted with more modest organizations.

The S&P 500 proposes a free-float market cap, which just considers shares promptly accessible for exchanging the market. This avoids limited shares held by significant investors or the actual organization.

Here is a worked-on breakdown of the estimation cycle

Compute Market Cap

For each organization in the S&P 500, duplicate the ongoing offer cost by the number of exceptional offers.

Compute Free-Float Market Cap: Think about just the tradable offers (free float) for each organization’s market cap.

Aggregate Market Covers

Add the free-float market covers of each of the 500 organizations.

List Worth

The S&P 500 worth is the all-out market cap of all constituents partition by a divisor. This divisor is a mind-boggling estimation that adapts to stock parts and corporate activities to keep up with congruity in the record over the long run.

Since the heaviness of each organization depends on its market cap, changes in the offer costs of huge organizations will altogether affect the by and large S&P 500 worth contrasted with more modest organizations.

I can’t give the continuous S&P 500 worth here, however monetary sites and media sources will have modern data.

Market Cap of Every Association

The S&P 500 is not set in stone considering the market cap of every association, which is identical to the proposition cost of the association copied by the total number of offers.

The S&P 500 List fills in as a gauge for the development of the U.S. value market. It tracks the value developments of 500 driving U.S. organizations, catching the movement of around 80% of the market capitalization of all U.S. Stocks.

The S&P 500 Took apart

The worth of the S&P 500 List is process by a free-float market capitalization-weight system.

The most vital phase in this approach is to register the free-float market capitalization of every part in the file. The free-float market cap is the complete worth of all portions of a stock that are at present accessible on the lookout.

This estimation takes the number of remarkable portions of each organization and increases that number by the organization’s ongoing offer cost, or market esteem.

The market capitalizations just incorporate offers that are accessible on the lookout. That prohibits shares assigned with practice freedoms to leaders and other closely involve individuals.

Ascertaining Business sector Load

This worth is utilize as the numerator in the file estimation.

For instance, Apple (AAPL) revealed 15.91 billion normal offers extraordinary as of Oct. 14, 2022, and it shut the day at a market cost of about $138.38 per share.

Certain organizations

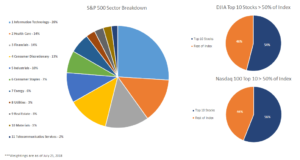

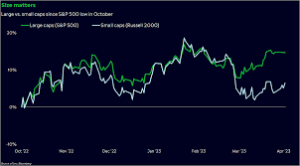

Certain organizations with market covers in the trillions can affect the S&P 500 as they rise and falls, yet it for the most part takes cost developments in whole areas to move the record significantly.

Since the list is expansive and differentiated, it commonly possibly takes a huge everyday action when significant occasions happen, for example, an adjustment of the government support rate or a conflict that influences exchange between business sectors.

Whenever financial backers look at individual stock execution against a record, they quite often utilize the S&P 500 as the perspective. Cash supervisors and common asset administrators analyze the presentation of their portfolios against the S&P 500 to decide whether they beat market returns.

How Is an S&P Not Entire Set in Stone?

The S&P 500 return is resolved the same way a solitary stock is still up in the air.

Expecting a monetary sponsor purchase receptiveness to the S&P 500 through an exchange-traded hold (ETF) like Secretive Specialist, and the value of the S&P 500 rising, the ETF’s expense will mirror that climb.

Value of the S&P 500 Matter?

Record is a benchmark of the strength of the U.S. markets. Its advancements reflect the total assessment of monetary supporters about the current status of the economy and its present moment.

The inverse is legitimate as well

The value of the record directly influences monetary supporter feelings and chance desire.

Furthermore, monetary supporters judge the show of their hypotheses against the introduction of the S&P 500. “Beating the market” means outperforming the S&P 500’s return.

The rundown incorporates 500 of the greatest public corporations recorded on the New York Stock Trade and the Nasdaq.

Its complete name is the Norm and Unfortunate’s 500 Record. Part possess and overseen by the organization’s cutting-edge manifestation, S&P Worldwide.

The main concern

The S&P 500 Record, despite being contain in 500 organizations, is moderate simple and clear to compute. Luckily, there is no requirement for any financial backer to do the estimation. The most recent worth of the record is continually accessible from many sources for most financial backers. It is a shorthand articulation of the present status of the business sectors.

Exchange in a hurry. Anyplace Whenever

One of the world’s biggest crypto-resource trades is prepared for you. Appreciate serious expenses and committed client care while exchanging safely. You’ll likewise approach Binance. Apparatuses that make it more straightforward than any time in recent memory to see your exchange history, oversee auto-ventures, view value outlines, and make changes with zero expenses. Make a record free of charge and join a great many dealers and financial backers on the worldwide crypto market.

What is the S&P 500?

The S&P 500, short for Standard and Miserable 500, is one of the central securities exchange records in the world. It contains 500 of the greatest public companies in the US and chose to address the show of the greater U.S. economy. Much of the time remembered to be a benchmark for the overall sufficiency of the U.S. monetary trade, the S&P 500 integrates associations from various endeavors, including development, clinical consideration, finance, purchaser items, and energy.

First introduced in 1957

The S&P 500 was made by the money-related organizations association Standard and Poor’s, which is right now a piece of S&P Dow Jones Records. The objective of the S&P 500 is to follow the showcase of the best relationships in the U.S., giving a broad glance at how the financial exchange and in addition, the economy are performing.

Significance of the S&P 500

The S&P 500 is overall considered one of the most stunning checks of the U.S. economy’s thriving since it combines relationships from basically every district of the economy. Monetary patrons, specialists, and policymakers use the record to measure the strength or deficiency of the protection trade, dissect the display of individual associations, and guide adventure frameworks. The list likewise fills in as a benchmark for the vast majority of shared reserves, trade exchanged reserves (ETFs), and other monetary items, implying that the exhibition of these speculations frequently intently follows the S&P 500.

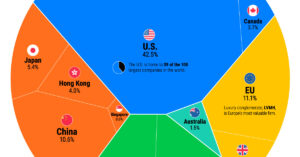

Besides, the S&P 500’s importance reaches out past the US. It is utilized universally by financial backers and business analysts to evaluate worldwide market patterns, and the exhibition of the S&P 500 frequently has suggestions for securities exchanges all over the planet.

Standards for Consideration in the S&P 500

In addition, any organization can be remembered for the S&P 500. An organization should meet a few rules to be considered for incorporation. These models guarantee that the organizations in the file are huge, deep-rooted, and monetarily stable:

Market Capitalization

To be qualified for incorporation, an organization should have a base market capitalization, which is presently around $14.5 billion. Market capitalization is determined by duplicating the organization’s stock cost by the absolute number of its exceptional offers.

U.S. House

The organization should be situated in the US and record its budget summaries with the U.S. Protections and Trade Commission (SEC).

Public Float: No less than half of the organization’s portions should be accessible for public exchange, implying that the organization’s stock can’t be excessively firmly constrained by insiders or institutional financial backers.

Liquidity: The organization’s stock should be effectively exchanged, with an elevated degree of liquidity, so financial backers can undoubtedly trade shares without radically influencing the stock cost.

An organization should be productive, with positive profit revealed in the latest quarter, as well as over the beyond four quarters.

Area Portrayal: The S&P 500 board of trustees likewise considers the general piece of the record while choosing organizations, guaranteeing that it mirrors a wide cross-part of enterprises.

How is the S&P 500 Determined?

The S&P 500 is a market-capitalization-weighted file, implying that the bigger an organization is (regarding market capitalization), the more impact it has on the record’s general execution. This technique guarantees that the development of bigger organizations, which greatly affect the economy, conveys more weight in the list than more modest organizations.

Bit by bit Computation of the S&P 500

Decide Market Capitalization The market capitalization of each organization in the S&P 500 is determine by duplicating. Its stock cost by the complete number of its extraordinary offers. For instance, on the off chance that an organization has 1 billion. Offers and the stock cost is $100, its market capitalization is $100 billion.

Work out the Absolute Market Capitalization of the Record

The all-out market capitalization of the S&P 500 is the amount of the market. Capitalization of each of the 500 organizations. For instance, on the off chance that the joined market capitalization of all organizations. In the file is $30 trillion, this addresses the general size of the record.

Dole out Weightings to Each Organization

The heaviness of each organization in the S&P 500 is determin by partitioning its market. Capitalization by the absolute market capitalization of every one of the 500 organizations. For instance, on the off chance that an organization’s market capitalization is $300 billion. And the all-out market capitalization of the file is $30 trillion, that organization would address 1% of the record.

List Divisor

To improve on the estimation, the all-out market capitalization of the record. The file divisor is an exclusive number set by S&P Dow Jones Lists. Which is change over the long run to represent changes on the lookout. Like stock parts or the expansion/expulsion of organizations. This divisor guarantees that the list esteem stays steady and similar. Over the long run, in any event when corporate activities change the market capitalization of individual organizations.

Last Record Worth

When the complete market capitalization by the file divisor. The subsequent figure is the worth of the S&P 500. This number varies all through the exchange day as stock costs change.