Why the Biggest Stock Market Crash

The greatest financial exchange crash in history is frequently viewed as the Money Road Crash of 1929, which prompted the Economic crisis of the early 20s. Here is a definite gander at the variables that added to this disastrous occasion:

Reasons for the 1929 Financial Exchange Crash

Hypothesis and Inordinate Purchasing on Edge:

During the 1920s, the financial exchange saw quick development and hypothesis, with numerous financial backers purchasing stocks on edge (getting the means to buy stocks). This training enhanced the dangers, as even a little drop in stock costs could crash financial backers’ value.

Securities exchange crashes have happened since forever ago, each with novel causes and effects. Here is a concise outline of probably the main accidents:

The Website Air pocket (2000)

Over-the-top hypotheses in Web-related organizations prompted an air pocket at the point when the air pocket burst and numerous tech organizations imploded. Critical misfortunes for financial backers and an ensuing downturn, especially influencing innovation.

The Monetary Emergency of 2008

Set off by the U.S. lodging bubble breakdown, prompting a credit crunch and the disappointment of major monetary organizations. The worldwide downturn, the enormous scope of joblessness, and huge government mediations, including bailouts and boost bundles.

The Glimmer Crash (2010)

On May 6, 2010, the U.S. financial exchange encountered an unexpected and serious drop in costs, trailed by a fast recovery. Raised worries about the dependability of electronic exchanging frameworks and high-recurrence exchanging, prompting an administrative investigation.

The Coronavirus Crash (2020)

The spread of the Coronavirus pandemic prompted an unexpected and sharp decrease in financial exchanges overall because of monetary closures and vulnerability. Provoked extraordinary money-related and monetary mediations to settle economies, trailed by a fast recuperation in securities exchanges.

Every one of these accidents had unmistakable causes, from speculative air pockets and poor monetary practices to more extensive financial and international elements. The ongoing idea is that they frequently lead to critical administrative changes and changes in market conduct.

Overproduction and Underconsumption

During the 1920s, critical modern and horticultural overproduction prompted an oversupply of merchandise. Nonetheless, compensation didn’t stay aware of creation, prompting underconsumption and an overabundance of unsold items.

Unfortunate Financial Practices

Many banks put vigorously in the financial exchange. At the point when the market declined, these banks confronted indebtedness, prompting a deficiency of trust in the financial framework and a flood of bank disappointments.

Absence of Guideline

The financial exchange was moderately unregulated, taking into consideration speculative air pockets and deceptive practices, for example, insider exchanging and market control.

Mental Elements

As stock costs fell, alarm selling followed. The trepidation and vulnerability exacerbated the downfall, prompting an enormous auction and a market slump.

Dark Thursday (October 24, 1929)

The underlying accident started on this day when the market opened 11% lower than the earlier days nearby. Notwithstanding endeavors by driving banks to settle the market, alarm selling proceeded.

Dark Monday (October 28, 1929):

The market lost another 13% in esteem.

Dark Tuesday (October 29, 1929):

The most exceedingly terrible day of the accident, with the market dropping another 12% Outcomes of the Accident

The Economic crisis of the early 20s:

The accident was a critical element prompting the Economic crisis of the early 20s, a very long-term monetary slump that impacted a large part of the world. Joblessness took off, organizations fizzled, and worldwide exchange declined.

Bank Disappointments

A great many banks fizzled, prompting the deficiency of investment funds for a large number of individuals. The absence of trust in the financial framework further developed the monetary emergency.

Social and Political Effects

The monetary difficulty brought about by the Economic crisis of the early 20s prompted broad social trouble and political changes, including the appointment of Franklin D. Roosevelt and the execution of the New Arrangement in the US.

Administrative Changes

Considering the mishap, basic managerial changes were introduced, including the Insurance and Exchange Commission (SEC) underpinning to control the monetary trade and the Glass-Steagall Act to disconnect business and adventure banking.

While the 1929 mishap is the most well-known, other basic protection trade crashes, for instance, the 1987 Dim Monday crash, the 2000 site bubble burst, and the 2008 financial crisis, essentially impacted the overall economy. All of these events had its unique causes and results, at this point they all element the characteristic flightiness and chance in financial business areas.

What is the justification behind the securities exchange?

Financial exchange crash: The vulnerability before Lok Sabha Political decision results, rising US Depository Yield, strain in the Center East, month-to-month expiry, and gouge to US Took care of rate cut trusts, are a portion of the significant reasons that have been hauling forefront Indian files, say specialists.

Put resources into what you know

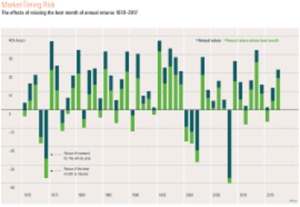

The buyer market that started in 2009 was straightforward — essentially every resource class thrived. That hasn’t been the situation since that bull run came to a sudden end toward the finish of 2021.

This implies that it’s significantly more essential to be specific in your ventures, particularly assuming you are an unpracticed financial backer. You ought to put resources into what you know.

“How we might get ready for future strife in the economy and the financial exchange is to be exceptionally mindful of what gambles with your speculations are presented to,” cautions Andrew Crème, CFP, of Creme Abundance Group.

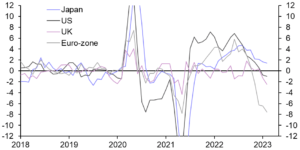

Watch out for the Central bank

Many powers are driving the ongoing business sector, above all, and preeminent is the Central Bank. The decrease in the market generally corresponds with rate increments carried out by the Fed or possibly the declaration of its expectation to do so late in 2021.

2023 appears to be one more year of proceeding with market instability because of dangers and vulnerabilities from the Central bank and international viewpoint,” alerts Vincent Grosso, the organizer behind Pascack Capital. “Market agreement shows the Fed keeping rates stale through most of 2023 and 2024, permitting no alleviation for customers. For people with cash stores and financial backers searching for money open doors, the increasing loan cost climate is invited because of the chance for unrivaled gets back with okay protections and money.”

You can have confidence that any strategy the Fed might take will significantly affect financial exchange execution.

Think about elective resources

This might be a choice if you are a more experienced financial backer who can add extra gamble to your portfolio. Incidentally, higher-risk resources perform better now and again than stocks and bonds during significant slumps. For instance, while the S&P 500 lost 18.32% in 2022, gold acquired 0.4% for the year.

venture stage that spotlights elective resource contributing, giving admittance to valuable open doors in areas like land, craftsmanship, marine, and legitimate money speculations, which were already blocked off to most individual financial backers and are intended to produce automated sources of income or value after some time.

Put resources into yourself

Truly, very few individuals consider putting resources into themselves to be speculation by any stretch of the imagination. In any case, if you have no control over what is happening in the monetary business sectors, you can be deliberate about working on yourself individually.

“Put resources into instruction and get new abilities to increment professional stability and procuring potential,” suggests Andrew Gershfeld, accomplice at Rock Capital VC. “Lessen spending to all the more likely oversee funds and possibly develop reserve funds. Keep up with great well-being to avoid excessive clinical costs and work on general prosperity. Invest energy with family and friends and family for everyday reassurance. Implore or ponder.”

Enlist a monetary consultant

If you’ve never managed a market decline or drawn-out bear market, the absolute best methodology might be to employ a monetary guide. Market slumps will more often than not be unusual, and that can make a counselor exceptionally alluring.

“As a financial exchange financial backer, one in every case should be ready for unforeseen unpredictability,” cautions Ben S. Untruths, president and boss venture official at Delphi Counselors, LLC. The more somebody realizes about the past, the more ready they are to manage the future, and the securities exchange doesn’t treat those who pursue rash choices. Moreover, having a speculation technique and monetary arrangement that has been pressure tried completely will bring inner harmony.”

Assuming you want assistance picking the right monetary counselor, you can exploit SmartAsset. You can utilize its monetary consultant matching instrument site page to look and choose the right monetary counselor for you.

The Greatest Securities Exchange Accidents

Securities exchange crashes are seismic occasions that shake economies, clear out abundance, and leave enduring scars on both monetary frameworks and public certainty. The greatest securities exchange crashes in history have been brought about by different elements, from monetary slumps to speculative air pockets, and have had sweeping outcomes. Figuring out the purposes for these accidents, their effect on the economy, and the examples they offer is basic for both policymakers and financial backers.

In this article, we will investigate probably the biggest securities exchange crashes, dig into their hidden causes, and analyze the results they had on both monetary business sectors and more extensive economies. We will likewise examine the illustrations gained from these occasions to forestall future crashes or moderate their belongings.

The Cash Street Crash

The Cash Street Crash of 1929, much of the time suggested as “Dim Tuesday,” is perhaps the most eminent monetary trade crash of all time. It indicated the beginning of the Financial emergency of the mid-20s and is a large part of the time referred to as an incredible portrayal of how speculative excesses can provoke shocking outcomes.

Speculative Air pocket: All through the 1920s, stock costs took off as financial backers accepted the market would keep on rising endlessly. This prompted a theoretical air pocket, where costs were driven not by organization basics but rather by sheer good faith and wild hypothesis.

Edge Exchanging

Numerous financial backers purchased stocks on edge, meaning they acquired cash to buy shares. At the point when stock costs began to fall, edge calls constrained financial backers to offer, prompting a descending winding.

Frail Administrative Oversight: During the 1920s, there were minimal guidelines for monetary business sectors, taking into account manipulative practices, for example, “siphon and dump” plots that misleadingly swelled stock costs.

Dark Monday (1987)

On October 19, 1987, the securities exchange encountered its biggest one-day rate drop ever, with the Dow Jones Modern Normal falling by 22.6%. This occasion, known as “Dark Monday,” was a reminder for monetary business sectors around the world.

Program Exchanging

One of the critical triggers for the accident was program exchanging, where PCs consequently executed huge orders because of market developments. As stock costs fell, these computerized sell orders exacerbated the downfall. In the years paving the way to the accident, stock costs had risen altogether, prompting worries that the market was exaggerated.

Market Brain Science

Dread and frenzy immediately spread among financial backers, causing a monstrous auction as individuals hurried to leave the market. Dark Monday caused a worldwide monetary shock, with financial exchanges all over the planet encountering huge misfortunes. Regardless of the seriousness of the accident, the economy didn’t fall into a drawn-out downturn, halfway because of fast activity by the Central Bank, which brought loan fees down to settle the monetary framework. Dark Monday featured the dangers of mechanized exchanging frameworks and the significance of market shields, like circuit breakers, to forestall alarm-driven sell-offs.

The occasion likewise highlighted the requirement for national banks to act quickly to keep up with liquidity and quiet business sectors during emergencies.

The Website Air pocket (2000)

The blasting of the website bubble in the mid-2000s was an exemplary illustration of a speculative lunacy driven by mechanical development. Financial backers ran to web-related organizations, accepting they would reform ventures and create monstrous benefits. Nonetheless, when the air pocket burst, it left numerous financial backers and organizations in ruins.

Unreasonable Extravagance

During the last part of the 1990s, web organizations with almost no profit saw their stock costs. Soar in light of the conviction that they would ultimately overwhelm the computerized economy.

Initial public offering Free for all: Numerous tech organizations opened up to the world about high as-can-be valuations, regardless of having doubtful plans of action or no benefits. Financial backers were anxious to purchase partakes in these organizations, further blowing up the air pocket.

The Monetary Emergency

The money-related crisis, regularly suggested as the Overall Money-related Crisis (GFC), was one of the most. Outrageous monetary ruts since the Financial emergency of the mid-20s. It was set off by a breakdown in the U.S. real estate market and the far-reaching disappointment of monetary foundations.

Subprime Home Loans

Paving the way to the emergency, banks gave hazardous subprime home loans to borrowers. With unfortunate credit, wagering that rising home costs would moderate any dangers.

These hazardous home loans were packaged into complex monetary items (contract-supported protections) and offered to financial backers, spreading the gamble all through the worldwide monetary framework.

Influence and Subordinates

Monetary foundations were exceptionally utilized, meaning they acquired enormous aggregates to put resources into these hazardous resources. While the real estate market imploded, these organizations confronted enormous misfortunes.

The breakdown of Lehman Siblings in September 2008 set off a worldwide monetary frenzy. Prompting a securities exchange crash and an extreme downturn.

Joblessness rates took off, shopper certainty plunged, and a huge number of individuals lost their homes because of dispossessions.

The greatest securities exchange crashes in history have been driven by various. Causes speculative air pockets, monetary bungles, mechanical advancement, and worldwide emergencies. While these accidents have made destroying impacts, they have additionally given important examples that have molded current monetary business sectors. Key among these illustrations are the risks of the hypothesis and the significance of guidelines. The requirement for quick activity by national banks and legislatures during emergencies.